Blended Retirement System

Guest Post – How to Apply for Continuation Pay Under the Blended Retirement System

By Dustin Schuett, DO

Note: The views expressed in this chapter are those of the author(s) and do not necessarily reflect the official policy or position of the Department of the Navy, Department of Defense, or the United States Government.

For those who elected into the Blended Retirement System (BRS), there is the opportunity to receive a one-time Continuation Pay bonus in exchange for 4 additional years of obligated service.

Continuation pay can in theory be taken anytime between 8 and 12 years of active service as calculated by the Pay Entry Base Date (PEBD, which can be found in block 4 of the LES labeled “PAY DATE”). The Navy (as well as the other branches) currently only allows Continuation Pay to be taken at the 12th anniversary of the member’s PEBD. Members can currently submit for Continuation pay when they are between 11.5 and 12 years from their PEBD. Essentially if you opted into the BRS and will be serving to 16 years due to pre-existing obligations or career plans/aspirations, you can take the continuation pay at 12 years. If you plan to get out of the Navy prior to serving 16 years, you should not take Continuation Pay as currently available.

The amount of the Continuation Pay can be set between 2.5 and 13 times monthly base pay for Active Duty servicemembers. The Navy (as well as the other branches) have taken the low end setting Continuation Pay bonus at 2.5x since its inception though 2020 rates have not been officially released. This bonus can be taken as a single lump sum or as 2 or 4 annual payments paying 50% or 25% per year respectively.

Understand that this means you will need to serve 4 years after receipt of the Continuation Pay. This obligation will “run concurrently with any other service obligation, unless other service obligations incurred specifically preclude concurrent obligations” per MILPERSMAN 1810-081 Section 7.

Verify that any pre-existing obligations can be served concurrent to (at the same time as) not consecutive to (following) any pre-existing obligations (ROTC, USNA, HPSP, USUHS, FTOS Training etc). I am currently carrying obligations for FTOS GME time for Fellowship training and a Retention Bonus which I am serving concurrently to my fellowship obligation as well as resident obligations. I contacted BUMED Special Pays who confirmed that my obligations do not require consecutive payback with other obligations.

I would strongly recommend anyone taking Continuation Pay to verify with BUMED Special Pays that their current obligations do not preclude a concurrent payback of obligation for Continuation Pay. Four years is a long additional commitment in exchange for only 2.5 months of base pay.

Here are the steps to obtain Continuation Pay in PDF form as well as below:.

- Go to the NSIPS website and log in.

- Select “Employee Self-Service” on the left side in the Menu box.

- Select “Blended Retirement System” under “Retirements and Separations” on the far right side.

- On the Blended Retirement System page, confirm that you are enrolled into the BRS and that the current date is between the 1st and last day eligible to elect by looking in the 2nd Box on this page.

- Select the “Continuation Pay” tab.

- Click the link for your “Continuation Pay Notification Letter” in the 3rd box from the top

- Save/print this letter for your records.

- Select “Yes, I elect Continuation Pay and agree to serve for an additional four years of obligated service from my date of eligibility”.

- Choose the Continuation Pay Payment option you desire from the listed options.

- Single Lump Sum Payment

- Two Annual Payments (50%)

- Four Annual Payments (25%)

- Click “Save” at the bottom of the page. This locks in your selection (don’t worry, you can still change the selection and opt out if you desire).

- I recommend checking to ensure everything has saved, to do this:

- Click “Home” in the top right corner of the page.

- Follow steps 2-5 above and ensure that your selections have been saved.

- Await your payment which per MILPERSMAN 1810-081 Section 8 b. will be on the 12th year anniversary of your PEBD (Pay Entry Base Date).

References:

Make Sure You Snatch the Blended Retirement System Match

Here’s a tip from one of my favorite blogs and authors, Jonathan Clements from Humble Dollar:

SNATCH THE MATCH. Are you on track to contribute enough to your 401(k) to get this year’s full matching employer contribution? If not, crank up your contribution now, so you can spread the required sum over this year’s remaining paychecks. In 2020, the maximum 401(k) contribution is $19,500, or $26,000 if you’re age 50 or older.

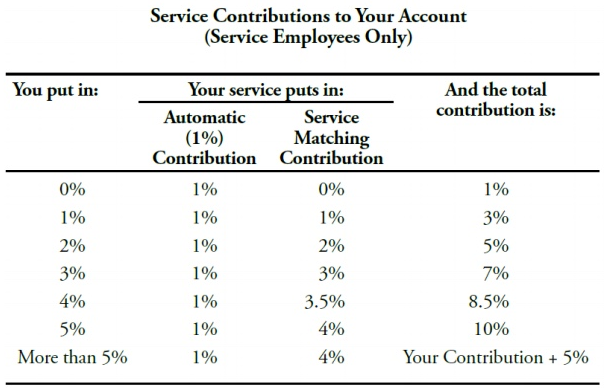

For nearly my entire career this wasn’t an issue for those in the military, but it is now due to the new Blended Retirement System (BRS) and its matching Thrift Savings Plan (TSP) contributions. To refresh your memory, if you contribute 5% of your pay to the TSP you get up to a 5% match. If you are in the BRS and you don’t contribute at least 5% every month, you are leaving free money on the table:

Also, you want to make sure you don’t fill up your TSP too early. While many service members will find it hard to get to the 2020 annual limit of $19,500, for those that do they want to space it out over the whole year. If you fill up your TSP in October and can no longer contribute for November or December, you won’t a get a match that month and will lose out on that money.

While I’m not in the BRS, I do a few things with my TSP contributions that I’d recommend everyone do:

- Contribute from your basic pay and not from bonuses or other variable or one-time pays. Your basic pay is the most consistent so use that.

- Spread it out over the whole year. For 2020, I’m contributing about $1625/month so that I come in just at the $19,500 limit in December.

- I see how much of my TSP is left after the November LES is released, and adjust December to get as close to the limit as possible.

Guest Post – Why Most of You Should Switch to the Blended Retirement System

By Dr. Keith Roxo, LCDR, MC(FS), USN*

My graduating class from the Naval Academy has just reached 20 years and the first in zone selection board for O-6 recently occurred. I was not in zone. This is because I am an O-4…for the second time. Even though I never had any intention of leaving active duty after my aviation contract, I did that very thing. Life has a way of intervening in our plans and we have to live and work within that reality. My reality was that at 10.5 years my spouse wanted me out. In hopes of averting marital disaster, I acquiesced and left active duty.

When I first arrived at the Naval Academy in 1994, the military didn’t even have the Thrift Savings Plan (TSP). The first enrollment period began in October 2001, 3.5 years after I was commissioned and more than 2/3rds of the way through my initial service obligation. Despite that, I was hooked for a bit longer as I was serving a concurrent obligation for an aviation contract that was eight years after my winging. I signed up for the TSP and have been contributing ever since. I was about to enter my first squadron and I was in the profession I had always wanted. I had no plans on leaving the military. If the Blended Retirement System (BRS) was available then I would not have switched and I would have been wrong given that I did leave active duty with no plan to return. As it turns out, my marriage failed anyway and I rejoined the military as a second time Ensign at USUHS.

By the time most physicians are able to leave, they are around half way to a retirement, as I was. I frequently tell people they shouldn’t leave the military for the money. You are giving up the ability to transfer the Post 9/11 GI Bill, the pension and the health benefit. Those are very valuable. But you shouldn’t stay for the money either. There is a lot that can happen between initially signing up for USUHS, HPSP, HSCP or FAP and when your commitment is up. Half way to a pension means you still have half to go. No amount of money is worth it if you are completely miserable and can do well enough in the civilian sector.

There have been countless articles that discuss the BRS (Editor – all of which can be seen here and here) and who, among the eligible, should or should not switch over to the new system. There are also numerous calculators that can show you, as best as possible, the actual number breakdown. However, few of these articles and calculators can account for the realities associated with leaving the military or staying until retirement eligibility. You never know what the next few years hold for you and how your goals in life may change, just as mine did.

This is why I recommend to all eligible people, who aren’t committed to well past 10 years, to make the switch to the BRS.

*The views expressed in this blog post are those of the author and do not necessarily reflect the official policy or position of the Department of the Navy, Department of Defense or the United States Government.

Reader Poll – Continue Financial Posts or Not?

As I announced here, I am now blogging for another site focused on personal finance for people in the military called MilitaryMillions.com. For example, here is a Blended Retirement System (BRS) Resource Center I created over there.

My plan was to transition all financial content to that new site because duplicating it in two different places is tedious and it is easy to follow the financial blog if you want that content. I’m curious, though, what MCCareer.org readers want.

For example, yesterday I found another PDF of frequently asked questions on the BRS. I ask you, the readers of MCCareer.org, what you would have wanted me to do with that PDF. Use the poll below so I get an idea of what you guys want:

MOAA Post – BRS Decision Should Consider the Whole Story

Here’s a link to a story from the Military Officers Association of American about the new Blended Retirement System (BRS):

BRS Decision Should Consider the Whole Story

The bottom line…

“When making the difficult decision about whether to switch to the BRS, keep in mind the conflicts of interest regarding the BRS: the government stands to save a significant amount with the BRS and, financial service firms can’t wait to guide members’ seeking investment advice into expensive investment products. Tread lightly.”

Questions and Answers about Opting into the Blended Retirement System (BRS)

Here is the latest PDF for those facing this decision (if you will have served for fewer than 12 years on December 31, 2017):

Questions and Answers about Opting into the Blended Retirement System (BRS)

Blended Retirement System: 6 Major Considerations Before You Choose

Here is a nice article for those debating between the current retirement system and the new Blended Retirement System or BRS:

Blended Retirement System: What Will You Do? 6 Major Considerations Before You Choose

Military Times Article – Blended Retirement: Should I Make the Switch?

Here’s a link to another article about the new blended retirement system (BRS):

Blended Retirement Opt-In Course on Joint Knowledge Online

I might be the only person who reads his entire LES every month, and I noticed this on May’s LES:

THE BLENDED RETIREMENT SYSTEM OPT-IN COURSE (2 HRS) (COURSE #J3OP-US1332) IS NOW AVAILABLE VIA JKO AT HTTPS://JKODIRECT.JTEN.MIL/ THE COURSE IS DESIGNED TO PROVIDE ELIGIBLE SERVICE MEMBERS INFORMATION FOR MAKING A DECISION ABOUT WHICH DOD RETIREMENT SYSTEM BEST MEETS THEIR NEEDS. THIS IS MANDATORY FOR ALL OPT-IN ELIGIBLE SERVICE MEMBERS.