Finance Friday Articles

Here are this week’s favorites:

10 Things Investors Can Expect in 2020

How a 28-Year-Old Used the GI Bill to Buy Multiple Rental Properties

Saving Money. How Much is Enough? The 30% Rule

Here are the rest of this week’s articles:

6 Life Laws That Will Make You Rich

7 Ways To Get Your Partner On Board Financially

8 Ways to Automate Your Finances

Are you a service member wanting to sock away $1 million for retirement? Here’s how

Episode #1: How Batching Might Save Your Personal Finances

From Residency to Real Money: Making the Transition as a Couple

How Much Money Do Doctors Make & Why It Doesn’t Matter

The Best Way for Millennials to Start Investing in Real Estate in 2020

Throwback Thursday Classic Post – What is a “Don’t Pick Me” Promotion Board Letter? Why Would You Send One?

If you go to the Navy Active Duty Officer Promotions Page, you’ll find this at the bottom:

Sample “Don’t Pick Me” Letter to the Board

Removing the introductory portion, here is what the meat of this letter says:

1. Per reference (a), please remove my record from consideration by the FY-2X Active Duty (Grade) (Competitive Category) Selection Board.

That’s it. All it says to the promotion board is, “Don’t pick me.”

Why would or should a physician send a letter requesting NOT to be considered by a promotion board? Here are a few reasons:

- You are an O4 or O5, know that you are resigning, and that you will not be joining the Reserves – If you are just paying your time back and getting out, do your fellow officer a favor and remove yourself from consideration. It is hard enough to promote to O5 and O6 nowadays. Having one less person to compete with helps out those who are willing to stick around. Yes, if you are picked and get promoted soon enough you could get some extra pay for a little while before you resign, but I’d say the general karma of letting someone else get the promotion outweighs that small financial benefit.

- You are an O4 or O5 who is retiring but you know that if selected for promotion you won’t accept it – Why would someone not accept a promotion? Because a promotion to O5 or O6 obligates you for 3 more years if you intend to retire. And the Navy still isn’t letting anyone get out early. If you want to get out as fast as possible with a 20 year retirement, taking a promotion to O6 in year 18 means you must stick around until year 21 at least.

Why is a “Don’t Pick Me” letter not applicable if you’re an O3? Because for physicians the promotion opportunity is “all fully qualified” or 100% for O4. In other words, if everyone in zone was fully qualified they could promote every physician who is a LT to LCDR. They generally don’t, but they could. You taking a promotion doesn’t really hinder someone else’s promotion like it does for O5 and O6.

So…if #1 or #2 above are applicable, consider sending a “Don’t Pick Me” letter. And remember, they are now due 10 days before a board convenes (not 24 hours like before).

The Blended Retirement System Lump Sum – Probably Not a Good Idea

Now that the Blended Retirement System (BRS) is in full effect, it is time to start digging a little deeper on some of its features, like the lump sum payment. Here is a pocket card put out by the DoD Office of Financial Readiness to explain the lump sum feature of the BRS:

Reading through the card, I think it does the best job I’ve seen so far at explaining how the lump sum option works, especially for those who don’t understand what discounting is:

Discounting is the process of determining the present value of a payment or a stream of payments that is to be received in the future. Given the time value of money, a dollar is worth more today than it would be worth tomorrow. Discounting is the primary factor used in pricing a stream of tomorrow’s cash flows.

When discounting future cash flows to determine the present value, you have to use what is very much like a reverse interest rate, called the discount rate:

The discount rate also refers to the interest rate used in discounted cash flow analysis to determine the present value of future cash flows.

The higher the discount rate, the lower the present value of your future cash flows and the smaller your lump sum would be. Some have criticized the DoD for setting the discount rate too high. While adjusted annually, it is 6.75% for 2020.

What I really found interesting about this pocket card I had found, and what caused me to write this blog post, was this part of it:

Note that the DoD Office of Financial Readiness is admitting, “For most Service members, a guaranteed stream of income for life is likely better than a lump sum.”

Yes! One of my biggest beefs against the BRS is that it gives you options like this and the chance to make a mistake. You can’t screw up the guaranteed stream of inflation-adjusted income that comes with the legacy retirement system.

You can screw up a lump sum, reduced by a high discount rate, by blowing it on an expensive car, too large of a house, a weekend in Vegas, or whatever else people like to waste money on. Yes, you could use it productively, perhaps to start a business, buy a franchise, or acquire high-paying skills with further education. But you could just as easily buy one of these:

Do yourself a favor. If you are in the BRS, when the time comes think long and hard before you reduce your future income streams and take a lump sum payment. As the DoD itself admits, “For most Service members, a guaranteed stream of income for life is likely better than a lump sum.”

FY21 Promotion Boards – What are They Looking At and How Can You Get Ready?

Here is a screencast/podcast of this updated lecture as well as the PDF of the slides I used:

FY 21 Promotion Boards Slide Deck

PRT Shift: What You Need to Know Now About Planking and Rowing

Here’s a link to this Navy Times article:

PRT Shift: What You Need to Know Now About Planking and Rowing

Make Sure You Snatch the Blended Retirement System Match

Here’s a tip from one of my favorite blogs and authors, Jonathan Clements from Humble Dollar:

SNATCH THE MATCH. Are you on track to contribute enough to your 401(k) to get this year’s full matching employer contribution? If not, crank up your contribution now, so you can spread the required sum over this year’s remaining paychecks. In 2020, the maximum 401(k) contribution is $19,500, or $26,000 if you’re age 50 or older.

For nearly my entire career this wasn’t an issue for those in the military, but it is now due to the new Blended Retirement System (BRS) and its matching Thrift Savings Plan (TSP) contributions. To refresh your memory, if you contribute 5% of your pay to the TSP you get up to a 5% match. If you are in the BRS and you don’t contribute at least 5% every month, you are leaving free money on the table:

Also, you want to make sure you don’t fill up your TSP too early. While many service members will find it hard to get to the 2020 annual limit of $19,500, for those that do they want to space it out over the whole year. If you fill up your TSP in October and can no longer contribute for November or December, you won’t a get a match that month and will lose out on that money.

While I’m not in the BRS, I do a few things with my TSP contributions that I’d recommend everyone do:

- Contribute from your basic pay and not from bonuses or other variable or one-time pays. Your basic pay is the most consistent so use that.

- Spread it out over the whole year. For 2020, I’m contributing about $1625/month so that I come in just at the $19,500 limit in December.

- I see how much of my TSP is left after the November LES is released, and adjust December to get as close to the limit as possible.

New in 2020: Marines Move to Greater Naval Integration, Starting with Training Changes

Here’s a link to this Marine Times article:

New in 2020: Marines Move to Greater Naval Integration, Starting with Training Changes

Finance Friday Articles

Here is an article about the pay raise we just got:

Biggest military pay raise in years takes effect Jan. 1; check out the complete chart

Here are my favorites this week:

3 Examples of Why Workaholic Real Estate Investors Have It All Wrong

6 Subjects That Should Have Sparked Your Curiosity in 2019

SECURE Act — 8 Things You Need to Know

Here are the rest of the articles:

7 Financial Planning Tips for Locums Docs

11 SMART Financial Goals for Your New Year’s Resolutions

An Unkind Act – The SECURE Act

Donating to a Vanguard Charitable Donor Advised Fund from a Vanguard Brokerage Account

How The SECURE Act Changes Your Retirement Planning

Investing in a Three Fund Portfolio Across Numerous Accounts. Get the Spreadsheet!

Is Buying Stocks at an All-Time High a Good Idea?

It’s So Important to Diversify Your Real Estate Portfolio

Risk Management in Private Real Estate: 3 Types of Uncertainty

SECURE Act And Tax Extenders Creates Retirement Planning Opportunities And Challenges

Thanks for Nothing, Financial Advisor

There are two versions of the S&P 500 index — this is the better investment

The Keys to Financial Success Are Incredibly Mundane (Sorry!)

The SECURE Act: What You Should Know About Retirement Account Reforms

Throwback Thursday Classic Post – Do You Still Need to Send the Above Zone Letter?

The standard advice has always gone something like this:

If you are above zone, you need to send a letter to the promotion board so that they know you are still trying to promote. Otherwise they won’t pick you.

Now that they no longer stamp officer records with “AZ” (above zone) and they look exactly the same as those records that are in zone, do you still need to write a letter to the board? Has the standard advice changed?

Reasons to Send a Letter to a Promotion Board

I addressed this in a post from a few years ago entitled “Should You Send a Letter to the Promotion Board?” I still agree with just about everything in that post, except for this:

“…you should always send a letter to demonstrate interest in getting promoted when you are above zone.”

In my opinion, you no longer need to send a letter just because you are above zone. If you have another reason to send a letter, then please do. If you are just sending one because you think you have to, I think that is no longer necessary.

The O6 promotion board convening orders state:

…in determining which officers are best and fully qualified for promotion, you are required to equally consider both above-zone and in-zone officers.

What if You’re Not Sure?

As you might imagine, I get asked a lot whether someone should send a letter to the promotion board. This is my standard response…

Pretend that you did not send a letter to the board, the board is over, and you were not selected for promotion. Are you going to be kicking yourself for not sending the letter? If the answer is yes or maybe, then send the letter. As long as you keep it short and sweet, there is no real downside.

Frankly, I think that when officers send letters to promotion boards they are often just making themselves feel better, and there is nothing wrong with that. You want to make sure that when the promotion board results come out, no matter what happened, you feel like you did everything you could to get promoted.

The Bottom Line

If you are above zone and want to send the letter just so there is no regret, feel free, but it is definitely not required to be considered for promotion.

2020 State of the Blog, the Facebook Group, and The Book

At the beginning of every year I give a general update on how the blog is doing. Enjoy!

Profit

As during previous years, profit was negative $99. I make no money on this, and it costs me $99/year.

Blog Traffic

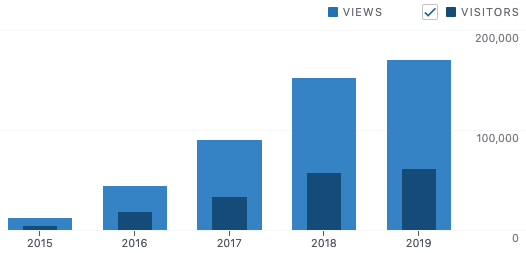

Here’s a graph of blog traffic since the blog was started in mid-2015:

The lighter color is page views and the darker color is visitors:

- 2015 – 3,705 visitors viewed 10,870 pages with 66 posts published

- 2016 – 18,373 visitors viewed 43,673 pages with 133 posts published

- 2017 – 32,569 visitors viewed 88,263 pages with 194 posts published

- 2018 – 56,674 visitors viewed 151,044 pages with 212 posts published

- 2019 – 60,771 visitors viewed 169,684 pages with 371 posts published

10 Most Popular Blog Posts and Pages in 2019

Here are the 10 most popular pages and posts in 2019:

- Joel Schofer’s Promo Prep – 4,065 views

- LCDR Fitreps – Language for Writing Your Block 41 – 3,682 views

- Joel Schofer’s Fitrep Prep – 3,035 views

- Useful Documents – 2,791 views

- POM20 Navy Medicine Billet Reduction – 2,556 views

- CV, Military Bio, and Letter of Intent Templates – 2,367 views

- Useful Links – 1,989 views

- Personal Finance – 1,407 views

- What are AQDs and How Do You Get Them? – 1,223 views

- About Me – 1,083 views

MCCareer.org Private Facebook Group

Some of the blogs I read have vibrant forums and Facebook groups where members interact and ask each other questions. I once started a forum on MCCareer.org, but no one used it so I folded it up. I still have a private Facebook group, though, with over 260 members.

Despite people joining the Facebook group, no one ever posts comments or questions to it. I think there’s only been one in two years. Plenty of people contact me individually to ask questions, so I know there are a lot of questions out there. In 2020, I’d encourage readers to use the Facebook group to get opinions and answers from people other than me.

MCCareer.org “The Book”

Very slowly we’ve been posting “chapters” to the MCCareer.org “book.” Book is in quotes because it really isn’t a book, but more of a collection of on-line posts or chapters. Interest in writing “chapters” has been low so far, although a few authors other than me have pitched in. Most chapters thus far have been written by me.

I’ve begun the process of adding all of my posts to the book page, as you’ll see if you take a look. Slowly but surely I’ll fill out the content outline with what I’ve already written, and if there are holes I’ll write content to fill it in.

I considered creating a wiki page instead, but I’m not willing to give up editorial control. Occasionally someone will post something inappropriate to the blog, and I need to make sure nothing gets posted that would derail my Naval career.

Check out “The Book” when you get a chance and see if there is something you’d be interested in contributing. If there is, contact me.