NDAA Expands Military Spouse Scholarship

Here’s a link to this article, which would only be applicable in this audience to spouses of ENS or LTJG officers. If you are one of these ranks and you have a spouse working on obtaining a “license, certification or associate degree to pursue any occupation or career” you might want to check it out:

White Coat Investor Tip on Pensions and Finance Friday Articles

I’m including this tip of the month from WCI’s newsletter (with permission) since it is relevant to just about everyone who reads this (subscribe to his newsletter here).

White Coat Investor’s Newsletter Tip of the Month – Pensions and Your Asset Allocation

A lot of people wonder how to incorporate their various sources of guaranteed income into their asset allocation. These include:

- Social Security,

- Pensions, and

- Immediate Annuities.

They wonder if because of their low risk that they should consider them “bond equivalents” and increase the stock:bond ratio in their portfolio to make up for the presence of these guaranteed sources of income. I believe there is a better way to look at this dilemma.

Rather than including them in your asset allocation and calling them bonds (which they are not), I recommend you leave them out of your asset allocation entirely. That’s right. Just leave them out. But when you go to calculate how much income you need from your portfolio, subtract the guaranteed income first. Let me explain:

Let’s say you need $120K to live on in retirement and are getting $40K from your Social Security. Instead of trying to calculate the present value of your Social Security income stream and adding that to your portfolio, just subtract that $40K from the $120K you need. Now you need your portfolio to provide $80K of income. Using the back of the napkin 4% rule to make the calculation you need a $2 Million portfolio in addition to Social Security. Easy peasy. If you also have a military or other pension or have purchased a Single Premium Immediate Annuity (SPIA) or two, you can subtract those too.

- $120K income need minus

- $40K Social Security minus

- $20K Pension minus

- $10K SPIA equals

- $50K needed from the portfolio. ($50K/4% = $1.25 Million)

So how should the presence of this guaranteed source of income affect your asset allocation? Well, it can go two ways. First, you could decide that now that you have all or most of your fixed income needs covered by these guaranteed income sources that you now have the ability to take on more risk. Or, alternatively, you might decide that since you have guaranteed income sources covering so much of your spending needs that really don’t need as much from your portfolio and can afford to take less risk with it. Perhaps these two factors cancel each other out and it doesn’t change your asset allocation at all.

What about other assets? Should they go into your portfolio? A lot of people wonder about their home and their mortgages in particular. While a mortgage acts like a very safe, very short-term “negative bond” (paying off a mortgage provides a guaranteed return equal to the after-tax interest rate), I wouldn’t include it in the portfolio. Nor would I include the house. Or your practice. And maybe even not your side gig small business. The main reason why is that it really complicates portfolio management. You know, the buying and selling and rebalancing you do periodically. For example, let’s say you included your house. When you are young and relatively poor, that is going to make up a massive portion of your portfolio. And later, when you are older, hopefully it will make up a tiny portion. How’s that going to work with trying to keep percentages equal? Same thing with a mortgage or a small business. And imagine trying to rebalance? What are you going to do when stocks poorly, take out a HELOC? Do yourself a favor–leave that stuff out of your portfolio and just let the presence of those things affect your overall asset allocation only as they change your need, ability, and desire to take risk. Don’t try to actually put them into your asset allocation.

Here are my favorites this week:

Practice Minimalism To Improve Your Financial Health And Quality Of Life

THE BEST CREDIT CARDS FOR ACTIVE DUTY MILITARY

When Does the Federal Deficit Matter?

Here are the rest of this week’s articles:

7 Things I Still Love About Turbo Tax in 2020

Considering a Syndicated Real Estate Investment Opportunity? What You Should Know

Crash Course in the Japanese Stock Market Collapse

How one decision can help you save for retirement

How Should I Save for College? Plus a 529 Plan Hack

How to Generate Over $5,000 Per Month With One Airbnb Property

Important Details Investors Should Know About The Coronavirus

Stop worrying about where the stock market goes from here and read this post

The Worst Money Decisions I Could Make

Top States To Buy Real Estate In The New Decade

What Counts as Compensation (Earnings) for IRA Contributions?

Throwback Thursday Classic Post – You Should Care About Promotion Board Precepts and Convening Orders

Whenever a promotion board starts, the members are provided two items to guide them as they decide who to promote, the board precept and the convening order. These documents are available on-line and should be used to figure out how to promote and write your fitrep.

The Board Precept

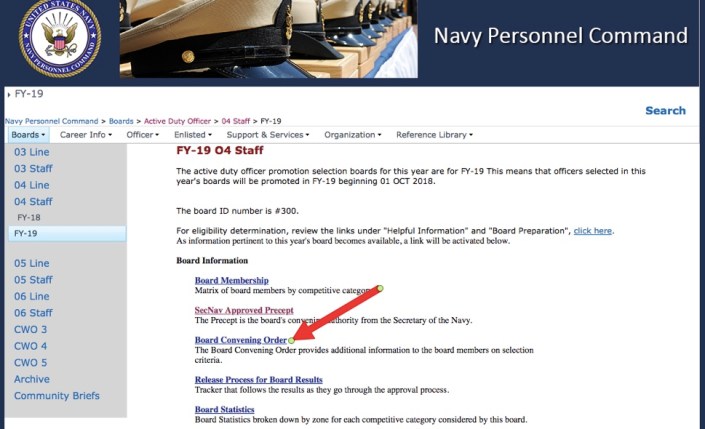

The precept is released in December and can be seen anytime afterwards. For example, if you go to the FY21 O4 Staff Corps Promotion Board page and click on the link titled “SecNav Approved Precept” you’ll get the board precept even though this board hasn’t started yet.

The Convening Order

The convening order for a promotion board is not released until it starts. If you monitor the board page closely, you’ll usually be able to get it within 1-2 days after the board begins. I was able to download the FY21 O6 board convening order on Tuesday of this week (2 days ago), the day it started. You just click the link that reads “Board Convening Order”, like in this image below for the FY19 O4 Staff board:

Incidentally, this is how I always find out the promotion opportunity for all the boards and post it on the blog. It is in the convening order.

Why You Should Care

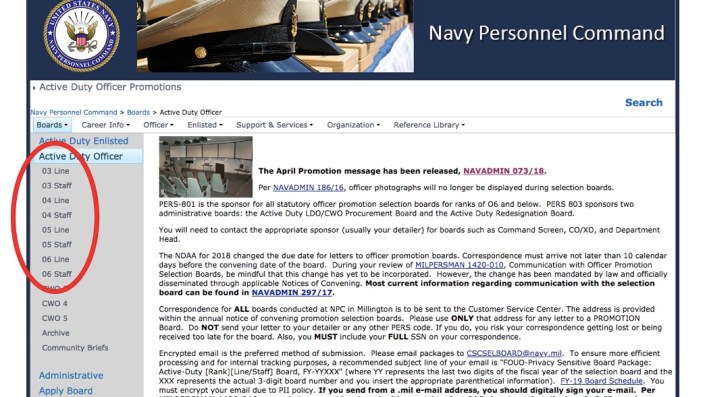

You should care about the precept and convening order because they tell you how to promote to the next rank. Go to this page and download them from the most recent boards of your next rank. You can see all the different boards circled in red here:

Click on the board for the next rank you’ll be competing for, and download the precept and convening order. If the board hasn’t happened yet (like the FY21 O4 board), then you’ll have to look at last year’s convening order (FY20).

Use these documents for two things. First, to figure out how to promote. For example, I deconstructed a past O6 convening order here.

Second, use them to come up with wording for your fitrep bullets, as discussed here where I showed you how to pull phrases for your block 41.

The Bottom Line

- Go to this page.

- Get the precept and convening order for your next rank. You might have to go to last year’s board for the convening order if the board hasn’t started yet.

- Use them to figure out how to get promoted and for writing your fitrep.

FY21 O6 Staff Corps Promotion Opportunities Released

The FY21 O6 Staff Corps promotion board started today, so they released the convening order. On page 2 you can find the promotion opportunities, which are:

- Medical Corps – 91% (the highest it has been since FY13, which is as far back as my data goes; it was 90% in FY19)

- Dental Corps – 90%

- Medical Service Corps – 50%

- Nurse Corps – 50%

If you need to review promotion board math, go here.

Sailors Access MyNavy Portal Without Common Access Card

Here’s a link to this article:

DHA Stands Up First Four Health Care Markets

Here’s a link to the article:

NCC Hematology/Oncology Fellowship Program Director Search

The National Capital Consortium (NCC) is looking for a Heme/Onc Fellowship Director. Applicants need to be eligible to PCS to the DC area in June of 2020. Packages should include CV, Bio, Letter of Intent and PERS concurrence on the PCS move and need to be submitted to me CDR Melissa Austin (contact in the global) NLT COB on 14 Feb 2020.

2021 Navy Legislative Fellowship Call for Applicants

The call for the Navy’s CY21 Legislative Fellowship has been released. The NAVADMIN can be found here:

https://www.public.navy.mil/bupers-npc/reference/messages/Documents/NAVADMINS/NAV2020/NAV20016.txt

Finance Friday Articles

Here are my favorite articles this week:

7 Ways For Physicians to Make an Extra $1000 a Month

Does Schwab’s growth threaten Vanguard’s domination?

How To Tell If Your Investment Plan Is Reasonable

Here are the rest of this week’s articles:

10 Financial Tips for New Attending Physicians

A Resident Physician on FIRE: How One Doctor Grows His Net Worth in Residency

A Tale of Two Retirements: FIRE and Traditional

AUM versus Flat-Fee: A Financial Advisor’s Perspective

Do You Define Wealth With Your Feelings or a Number?

For The Best Mortgage Rate, Refinance Before These Three Life Events

Go Ahead and Pay – Bonds and Retirement Accounts

My 6 Biggest Fears About Buying My First Rental Property

Owning a Home is Not For Everyone

Paying Yourself First – 6 Ways to Automate Your Financial Life

Questions From Physician Real Estate Investors

Should You Manage Your Own Rental Properties?

Side Gigs for Pre-Med and Medical Students

Strategies for Young Investors

Throwback Thursday Classic Post – Getting Retirement Credit for HPSP in the Reserves

In the recently released Winter Medical Corps Newsletter, I noticed this paragraph in the “Readiness in the Reserves” article:

Shipmates,

I have just returned from PERS-9 (Reserves), reviewing important administrative processes. Here is the gouge…

HPSP Credit: Jeanitta Edwards verifies that the member was a HPSP participant and that the member is in a critical wartime skill (defined by DOD each year). Once she verifies this information, she sends it to another individual to load in the points for the year as credit towards retirement. The instruction requires a full year of service to receive credit for 1 year and caps the credit at 4 years. Unfortunately, because many medical schools start in July and graduate in May, the 4th year does not qualify. Some may have earned other points that year which can carry over for credit towards a good year. The 15 gratuity points are allocated on a pro rata basis so you will only get half those points for a half a year of participation. We will post the guiding documents to the Medical Corps Homepage. Please note that the actual HPSP policy is currently being rewritten.

A reader asked, “What are the official critical wartime specialties?”

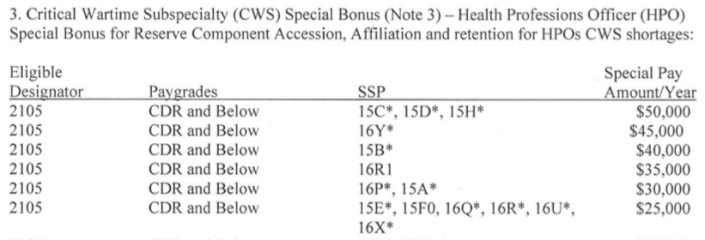

Here is the portion of the document that lists them:

So what do those mysterious codes mean? They are defined in the Promo Prep, but since I’m such a nice guy here is the translation. The CWS include:

- General Surgery (15C)

- Neurosurgery (15D)

- Orthopedics (15H)

- Radiology (16Y)

- Anesthesia (15B)

- Internal Medicine Subspecialties (16R1)

- Emergency Medicine (16P)

- Flight Surgery (15A)

- OB/GYN (15E)

- GMO (15F)

- Family Medicine (16Q)

- General Internal Medicine (16R)

- UMO (16U)

- Psychiatry (16X)

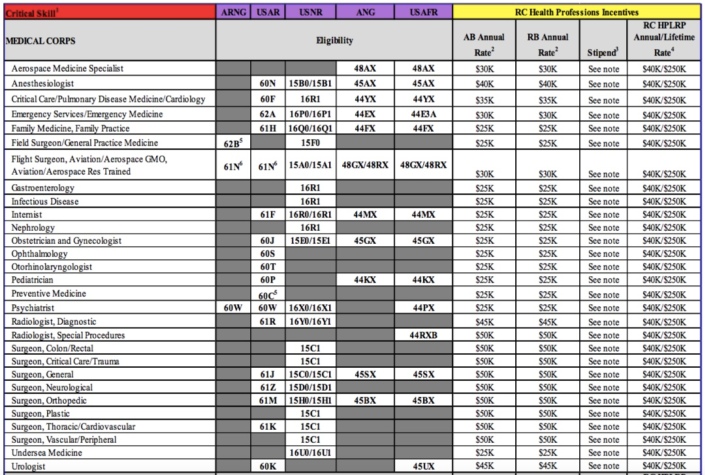

Update just prior to publication – My wife (a Reservist) was sent this chart in the Health Professions Officer Special and Incentive Pay Plan, and the specialties under “USNR” match the list above:

If you are in one of these specialties, you can get retirement credit for your time in HPSP (or at least 3 years of the 4). In addition to the info above, here is what else I could find about this program:

Army Policy – Guidance on Reserve Service Credit for Participation in DOD HPSP and FAP

Recruiting and Retention Incentives for Reserve Component Health Professions Officers