Retirement

PoF Blog Post – Financial Implications of Leaving a Military Medicine Position

One of my readers pointed me to this blog post on Physician on Fire, which many of you will find interesting:

Financial Implications of Leaving a Military Medicine Position

If you’d like my own thoughts on the value of a military pension, you can read them here:

Blended Retirement System: 6 Major Considerations Before You Choose

Here is a nice article for those debating between the current retirement system and the new Blended Retirement System or BRS:

Blended Retirement System: What Will You Do? 6 Major Considerations Before You Choose

Military Times Article – Blended Retirement: Should I Make the Switch?

Here’s a link to another article about the new blended retirement system (BRS):

Personnel Chiefs Worry Over Deployment Pace, New Blended Retirement

Here is a link to an article that discusses two genuine concerns, the current operational tempo and the new Blended Retirement System (BRS):

Personnel Chiefs Worry Over Deployment Pace, New Blended Retirement

Beta Test of the DoD’s Blended Retirement System Calculator

Here is a link to the beta test of the Department of Defense Blended Retirement System Comparison Calculator:

Blended Retirement System Comparison Calculator – Beta Version

You Were Selected for Promotion to O5 or O6 – Should You Accept It?

BLUF – If you are hoping to retire but are not willing to serve 3 years as a Commander or Captain, you should decline the promotion. (This is not applicable if you are resigning. Only if you are hoping to retire.)

The policy regarding promotions and retirements is governed by OPNAVINST 1811.3A. If you are lucky enough to be selected for promotion to O5 or O6, you should be familiar with this instruction and make sure you are willing to spend 3 years as a CDR or CAPT before you plan to retire.

Paragraph 4b of the OPNAVINST states:

“Officers must satisfy the minimum active duty time-in-grade requirement to retire in the highest grade satisfactorily served…Officers who desire to retire before completion of the minimum time-in-grade requirement must decline appointment to the next higher grade. Officers who have accepted appointment to the next higher grade must satisfy the retired grade criteria in paragraph 7.”

Seems like we need to go to paragraph 7…

“7. Time-in-Grade Requirements. Unless retirement in the next inferior grade is directed by SECNAV for an officer or warrant officer under reference (c), then officers, warrant officers, and enlisted members retired voluntarily or transferred to the Fleet Reserve shall be retired in the highest grade satisfactorily held upon completion of the following time-in-grade requirements…Three years for an officer serving on active duty in pay grade O5 or O6.”

Paragraph 5b states:

“Unless waived by proper authority, approval of requests for voluntary retirement or transfer to the Fleet Reserve will normally be denied until an individual has completed: (1) The applicable time-in-grade requirements of paragraph 7;”

In addition, paragraph 7e states:

“COMNAVPERSCOM shall normally deny retirement requests or Fleet Reserve requests of members serving on active duty in, whose length of service in the highest grade held while on active duty does not meet the time-in-grade requirements specified above.”

What’s the bottom line? There are certain exceptions spelled out in this policy, and you can get information on time-in-grade or next-lower-grade waivers here and here, but if you want to retire and accept promotion to CDR or CAPT you should be willing to serve in that rank for 3 years. Otherwise, you should decline the promotion.

Detailing Update – Orders, PRDs, Resignation, Retirement, a Survey, and War College

Here are a few notes one of the Detailers sent out yesterday:

Delayed Order Release

Due to financial constraints, no orders have been released in the last several weeks. We acknowledge this is incredibly inconvenient to our constituents. Standby for more information, we will pass it as we get it.

Expired Projected Rotation Dates (PRDs)

Many officers have PRDs that are set to expire this summer. Officers with expired PRDs are attractive targets to place in high priority OCONUS and operational billets. Please get your extension requests in ASAP.

Resignation/Retirement

Officers planning to resign or retire should have their requests in 9 months prior to their requested detachment month. Requests turned in less than 6 to 9 months prior to requested detachment will be kicked back. There were several officers extended past their obligation because they did not send their request in on time.

I recommend reading CDR Schofer’s blog post entitled “How to Resign Worry Free.”

The earliest these can be submitted is 12 months prior to requested detach date.

Survey for Officers with a 2017 PRD

If your PRD was in 2017 and you accepted PCS orders or extended, please consider completing a one minute survey to assess attitudes regarding the billet assignment process among Medical Corps officers. The survey will close June 1st.

Last year we administered a survey of Navy Medical Corps officers to assess attitudes regarding the billet assignment process. We took measures to improve the process for billets assigned in 2017 and we are administering another short survey to measure improvement. The results, available at the end of the survey, will be briefed to leadership and made public. THANK YOU!

Naval War College

PERS needs people for the August 2017 Naval War College class. Applicants must have completed Joint Professional Military Education 1. They will consider breaking orders for appropriate applicants. Please see this blog post for a War College description by a current student.

USAA Launches New Online Calculator to Assist with Changes from DoD’s New Blended Retirement System

Here is a link to an article about this tool:

USAA Launches New Online Calculator to Assist with Changes from DoD’s New Blended Retirement System

Here is a direct link to the tool:

Blended Retirement System Opt-in Course Now On-Line

By Chief of Naval Personnel Public Affairs

WASHINGTON (NNS) — Tuesday, the Navy released NAVADMIN 020/17 announcing the release and availability of the Blended Retirement System (BRS) Opt-In course.

The decision to stay in the current retirement system or opt-in to BRS is an important and irrevocable decision that eligible Sailors must make based on their own individual circumstances. This course aims to help eligible service members make that decision.

All service members who are opt-in eligible must complete the Blended Retirement System training, now available on Joint Knowledge Online (JKO) at: http://jkodirect.jten.mil/html/COI.xhtml?course_prefix=J3O&course_number=P-US1332 (course #: J3O P-US1332). The training will be available soon on Navy e-Learning.

Active Component (AC) members are eligible to opt-in if they entered military service on or before Dec. 31, 2017, and have less than 12 years of service.

Reserve Component (RC) members, including Full Time Support (FTS) members, can opt-in if they entered military service on or before Dec. 31, 2017, and they have accumulated fewer than 4,320 retirement points as of Dec. 31, 2017.

United States Naval Academy and Reserve Officer Training Corps Midshipmen as well as Delayed Entry Program service members are opt-in eligible if they entered the military on or before Dec. 31, 2017.

Eligible Sailors should have received notification of their opt-in eligibility via email (sent to the email address registered to an individual’s Navy Standard Integrated Personnel System (NSIPS) account). Command administration departments must contact their personnel support divisions to access a list of all opt-in eligible members within their command and then notify all opt-in eligible members within their units.

In order to ensure opt-in eligible Sailors are making the most informed decision possible, a few additional tools have been developed for use. Additionally, an on-line calculator is expected to be released in March to aid eligible members in their decision making process.

The Navy has also developed the Navy Financial Literacy app that is designed to provide Sailors with access to both training and resources, which is especially critical during the transition to BRS. The free app is available for download now at the Google Play and iTunes app stores. To find the app, search “Navy Financial Literacy” in the app stores or in your web browser.

For the most up-to-date information on BRS and links to training go to the Uniform Services Blended Retirement web page at http://militarypay.defense.gov/BlendedRetirement/.

For complete information on BRS opt-in training requirements and availability see NAVADMIN 020/16 at http://www.npc.navy.mil.

For more information, visit www.navy.mil, www.facebook.com/usnavy, or www.twitter.com/usnavy.

For more news from Chief of Naval Personnel, visit www.navy.mil/local/cnp/.

Opt-In to Blended Retirement System NAVADMIN

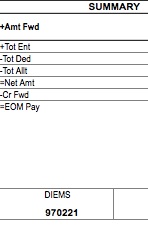

Below is the Blended Retirement System (BRS) NAVADMIN that just came out. If you are one of the people who can choose between the current system and the BRS, you can read what I think about it here. Active duty are opt-in eligible if their Date of Initial Entry into Military Service (DIEMS) is on or before 31 December 2017 and they have less than 12 years of service as of 31 December 2017. You can find your DIEMS on your LES on the right-hand side. Here is an image of my LES where you can see my DIEMS is February 21, 1997:

Because I have more than 12 years of service, I am not opt-in eligible and have to stay with the current system (thankfully).

Bottom line…stay with the current system if you are staying in for 20 years.

UNCLASSIFIED

ROUTINE

R 281546Z NOV 16

FM CNO WASHINGTON DC

TO NAVADMIN

INFO CNO WASHINGTON DC

BT

UNCLAS

PASS TO OFFICE CODES:

FM CNO WASHINGTON DC//N1//

INFO CNO WASHINGTON DC//N1//

NAVADMIN 259/16

MSGID/GENADMIN/CNO WASHINGTON DC/N1/NOV//

SUBJ/NOTIFICATION OF ELIGIBILITY TO OPT-IN TO THE BLENDED RETIREMENT SYSTEM//

REF/A/DOC/NDAA/13APR15//

REF/B/MSG/CNO WASHINGTON DC/271444ZSEP16//

REF/C/MSG/COMNAVPERSCOM MILLINGTON TN/151015ZAUG16//

NARR/REF A IS SECTIONS 631 THROUGH 635 OF NATIONAL DEFENSE AUTHORIZATION ACT,

SUBTITLE D – DISABILITY PAY, RETIRED PAY, AND SURVIVOR BENEFITS.

REF B IS NAVADMIN 217/16, ANNOUNCEMENT OF THE BLENDED RETIREMENT SYSTEM FOR

THE UNIFORMED SERVICES.

REF C IS A GENADMIN, PAY AND PERSONNEL INFORMATION BULLETIN 16-12.//

RMKS/1. This NAVADMIN is the official notification of eligibility to opt-in

to the Blended Retirement System (BRS) in accordance with references (a) and

(b).

2. Reference (a) states all Service members with a Date of Initial Entry

into Military Service (DIEMS) on or before 31 December 2017 are automatically

grandfathered under the current retirement system. However, some Service

members are eligible to opt-in to the BRS.

(a) Active component members are opt-in eligible if their DIEMS is on or

before 31 December 2017 and they have less than 12 years of service as of 31

December 2017, based on their Pay Entry Base Date.

(b) Reserve component members, to include Full-Time Support members, are

opt-in eligible if their DIEMS is on or before 31 December 2017 and they have

accumulated fewer than 4,320 retirement points as of 31 December 2017.

(c) United States Naval Academy, Reserve Officer Training Corps

Midshipmen and Delayed Entry Program members are opt-in eligible if their

DIEMS is on or before 31 December 2017.

3. The window for opt-in eligible members to enroll in BRS will be open from

1 January 2018 until 31 December 2018. Opt-in eligible Service Members must

be in a paid status at the time of enrollment. Service Members who meet the

criteria above but are not in a paid status during the election window, will

be given an opportunity to enroll during their first period of paid status.

Hardship extensions to the enrollment window for opt-in eligible Service

Members who are unable to enroll in BRS during the 2018 enrollment period

will be considered on a case by case basis in line with reference (a). If a

Service Member chooses to opt-in, their decision is irrevocable. Whether you

choose to opt-in or not, all Service Members who are opt-in eligible must

complete the Blended Retirement System Opt-In Course.

4. Commands must notify all opt-in eligible Service Members within their

command. Command administrative departments should also contact their

personnel support divisions on a regular basis to access a list of all opt-in

eligible Service Members within their command. Additionally, those opt-in

eligible Service members who have an up-to-date email address in Navy

Standard Integrated Personnel System in line with reference (c) will receive

notification of opt-in eligibility via e-mail.

5. All Navy commands must ensure that opt-in eligible Service Members

complete the Blended Retirement System Opt-In Course. This course will be

available in January 2017 on Joint Knowledge Online and Navy E-learning.

Although this course will be accessible by all Service Members, completion no

later than 31 December 2017 is mandatory for all opt-in eligible Service

Members. Additionally, command financial specialist can provide support for

unit-level basic financial literacy and BRS education. More robust financial

counseling services are available through personal financial managers at your

local Fleet and Family Support Center or online via a Military OneSource

personal financial counselor.

6. The importance of the decision to enroll in BRS or remain in the current

retirement system cannot be overstated. This decision is among the most

important financial decisions an opt-in eligible Service Member may make. I

am depending on an all-out leadership effort to ensure that the training is

completed and Service Members are making the most informed financial decision

possible.

7. This NAVADMIN remains in effect until superseded or cancelled, whichever

comes first.

8. Released by Vice Admiral R. P. Burke, N1.//

BT

#0001

NNNN

UNCLASSIFIED//

- ← Previous

- 1

- …

- 5

- 6

- 7

- Next →