NMCP Hosts ‘The Future of Military Medicine’ Discussion Panel

Here’s a link to this article about a panel I was on:

NMCP Hosts ‘The Future of Military Medicine’ Discussion Panel

Do the TSP Target Date Funds Miss the Mark?

Blooom is an on-line financial advisory service that will manage your Thrift Savings Plan (TSP) and other retirement accounts for only $10/month. On another blog I wrote an article about them and some readers got into a Twitter dialogue with them. During this dialogue it was suggested that an investor doesn’t need to pay $10/month for an advisor because you can always just use target date funds if you don’t want to manage your investments yourself. Blooom’s response pointed to a blog post of theirs about target date funds and all the problems associated with them. Let’s take a look at their post and see if the points they raise are valid when compared to the TSP’s target date funds, the Lifecycle Funds.

What’s a Target Date Fund?

According to Investopedia, a target date fund is:

A fund offered by an investment company that seeks to grow assets over a specified period of time for a targeted goal. Target-date funds are usually named by the year in which the investor plans to begin utilizing the assets. The funds are structured to address a capital need at some date in the future, such as retirement. The asset allocation of a target-date fund is therefore a function of the specified timeframe available to meet the targeted investment objective. A target-date fund’s risk tolerance become more conservative as it approaches its objective target date.

The Lifecycle or L Funds are the TSP’s version of target date funds. You can read my deep dive on them if you like for more information.

Are the Lifecycle Funds Too Conservative?

Yes, in my opinion, the L Funds are too conservative when compared to other target date funds and the fact that many of us will have an inflation-adjusted pension. To compensate you can always just pick a L fund that targets a later year. When I used the L funds in my TSP, that is what I did.

For example, if you want to retire in or around 2030 you would normally pick the L 2030. Instead you could pick the L 2040 or L 2050 to get more aggressive. That said, the most aggressive you can get with the L Funds right now is the L 2050, which is 82% stocks and 18% bonds. If you want less than 18% bonds, you can’t do that with any of the current L funds.

Do the Lifecycle Funds have High Expense Ratios?

This is a definitive no. While other target date funds can have high expenses, the L funds are composed of funds with the lowest expenses you will find anywhere. You probably cannot find a target date fund with lower expenses than the TSP L Funds.

Do the Lifecycle Funds Lack Personalization?

Yes, they do. There’s no way around this one. You can personalize them a little bit by adjusting the target date you invest in, as described above, but they are by definition standard for all investors.

I would argue that these standard asset allocations are good enough for just about everyone to come up with a reasonable investment plan. If you want a personalized plan, though, you may have to get some help or use a financial advisor.

The Bottom Line – Do the L Funds Miss the Mark?

I think it depends. They are definitely low cost, so they hit the target there. I do think that they are too conservative, but as long as you are OK with a minimum bond allocation of 18% you can just adjust that by using a fund with a target date that is further off. They are definitely not personalized, but I don’t think they need to be. The asset allocations they use would do for 99% of the people investing, including myself.

Finance Friday Articles

My favorite article this week:

Pizza Delivery is for Millionaires

Here are the rest of this week’s articles:

Be Proactive, Not Reactive When It Comes To Creating Passive Income

Don’t Compare Your Finances/Investing to Others

How Much Money Does a Doctor Need to Retire?

Maintaining a Small RV for Retirement Travel

Should You Turn Your Starter-Home into a Rental?

The Value Proposition of a Real Estate Access Fund

Updated Trinity Study Results for 2019 – More Withdrawal Rates!

Throwback Thursday Classic Post – How to Find Out Your Reporting Senior’s Fitrep Trait Average

One of the most important markers of a good fitrep is that your trait average is above your reporting senior’s trait average. Since most officers initially write their own fitrep and create their own trait average on the first draft, it is important to find out your reporting senior’s trait average so that you can try to be above it. Here are a few ways to find out what it is.

First, in order to have a trait average, your reporting senior has to have served as the reporting senior for officers of your same rank from any corps. If they have not done this, they’ll have no pre-existing average. For example, if you are a LCDR, your reporting senior does not have to have ranked LCDR physicians. If he/she has ever ranked a LCDR of any kind (nurse, line officer, etc.), then they will have an average.

If they have an average, here are the ways I know of to find it:

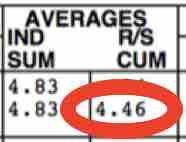

- If you’ve already received a fitrep from them in your current grade, then you can look at your Performance Summary Report or PSR, which you download from BUPERS On-Line. The number in the lower right in the “AVERAGES” column (circled below) is their average for that rank.

- If you haven’t received a fitrep from them, maybe you have a friend in the same rank who has received a recent fitrep from them. You can look at their PSR if they’ll let you.

- You can ask your chain of command or command fitrep coordinator. They often know because they are trying to make sure that all of the fitreps being done don’t change the reporting senior’s average in ways he/she doesn’t want.

- You can ask the reporting senior. They just may tell you.

The bottom line is that if you are drafting your fitrep, you want to try and find out the average and grade yourself above it. In the end, the ranking process may move you below it, but by submitting the draft with an above average grade you may increase the chances you stay above it.

FY20 War College Cheat Sheet

Everyone should try to get Joint Professional Military Education (JPME), especially in our new operationally focused environment. To assist you, here is the FY20 War College Cheat Sheet:

FY20 War College Cheat Sheet (Final)

I also added it to the Useful Documents page.

If you want more info about JPME, you can go to this page at Navy Personnel Command.

Global Health Specialist Program Information Package

We have put out a lot of Global Health Engagement (GHE) opportunities lately. You can see all of them past and present at this link. Many officers are wondering how they can get the GHE additional qualification designator (AQD).

Here is a information package that explains the entire program, including how to get the AQD:

Assistant Deputy Chief, M2 – Research & Development at BUMED – O5/O6

BUMED is looking for an O-5/O-6 to fill the Assistant Deputy Chief for Research and Development (M2) position in June of 2020.

CAPT Matthew Lim is the incumbent and his contact is in the global address book for questions. Here’s some additional info, if interested:

Assistant Deputy Chief Research and Development M2

Interested candidates should submit their CV and Bio to CDR Melissa Austin (also in the global) NLT 27 November with Detailer/Specialty Leader concurrence that you are eligible to PCS.

Navy Times – Prognosis Good for Navy Medicine, But Budget Concerns Loom

Here’s a link to this article:

2 Important TSP Changes and Finance Friday Articles

This week I’d like to highlight the 2020 TSP contribution limits, which will be $19,500 for most of us, as well as the instructions for enabling 2-factor login, which will be required as of 1 DEC:

TSP Contribution Limits for 2020

TSP 2-Factor Login Instructions

Here are the rest of the articles:

2020 Tax Brackets, Standard Deduction, and Other Changes

6 Bare Minimum Tasks to Fix Your Finances

Are Real Estate Investments Resistant to Inflation?

Bernstein Says Stop When You Win The Game

Financial Burdens and Physician Burnout

How to manage money for financial success in the U.S. military

How to Think About Money: A Physician on Fire Review

Into a Cloud – Letters from a Downed World War II Pilot

Lessons Driving an $800 Car Can Teach Your Kid

Non-Intuitive Lessons From the Man Who Solved the Market

Student Loan Planner Reviews: Honest Opinions from Three Former Clients

The 3 benefits of charitable giving

The Price of US Stocks and Signal Failure

Trends That Matter in Asset Management

TURNKEY RENTALS DON’T HELP YOU ACHIEVE FAST FIRE

Using Your Estate Plan to Have a Graceful Exit

What does buying a new car really cost over the years?

Why are Doctors Burning Out? Three Ways FIRE Can Save Us

Why Timing the Market is a Fool’s Errand