Automate Your Bill Paying

Here’s a tip from one of my favorite blogs and authors, Jonathan Clements from Humble Dollar:

AUTOMATE YOUR BILL PAYING. That way, you’ll avoid late payments—crucial to maintaining a good credit score. The downside: You need to be vigilant about keeping enough in your bank account, so you don’t trigger fees for overdrafts or insufficient funds. This is a particular concern with credit card bills, which can vary so much from one month to the next.

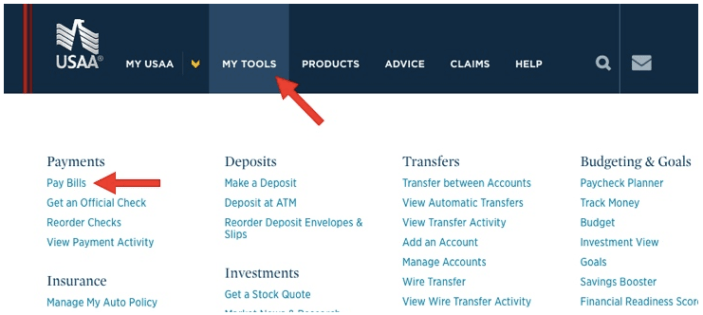

How do you do this with USAA, which is where I do my banking?

To sign up with USAA, go here:

Authorship and Academic Careers in the Navy

I recently gave a talk to the Emergency Medicine residents at NMC Portsmouth about authorship and academic careers in the Navy. Here is the outline of the talk and some tips…

Academic Career Options

There are a number of options for those who are interested in establishing an academic career in Navy Medicine. Here are the ones I know of:

- Residency programs at a medical center – Serving as teaching faculty at a residency program at Walter Reed, San Diego, or Portsmouth.

- Family Medicine (FM) teaching hospitals – Serving as faculty at the FM residency programs in Ft. Belvoir, Lejeune, Camp Pendleton, and Jacksonville. This opportunity is not just for FM physicians, but for Internists, Pediatricians, subspecialists, etc. as the FM programs need all of those people to support the education of their residents.

- Japanese internships – Both Yokosuka and Okinawa have internships that are structured like Transitional Internships and allow Japanese physicians to learn how American medicine is conducted. Most graduates try to obtain letters of recommendation and apply for graduate medical education (GME) in the US. Taking a leadership role in these programs can prepare you to lead GME programs when you PCS back to the US.

- Transitional internship programs – Leadership opportunities in Transitional Internships are open to just about every specialty, and many physicians have used Transitional Internship Program Director as the stepping stone to O6.

- Uniformed Services University of the Health Sciences (USUHS) billets – Many specialties have billets at USUHS that allow you to take a leadership role in the departments and teach medical students.

Authorship Options

The opportunities to publish have increased dramatically during my 18.5 year career. For example, you’re reading this blog and that didn’t exist when I started. Here are the opportunities to publish that currently exist with some tips listed after each:

- Apps – This is the only thing on this list I haven’t tried, but there are articles that explain how to do it and tell stories of physicians who made money doing it.

- Blogs – This isn’t hard to do, so there’s nothing but time and effort preventing you from putting your opinion out there for others to read. Don’t underestimate how much time this takes, though, so know what you are getting into. I have literally spent thousands of hours on this blog.

- Books and book chapters – I’ve published 4 books (you can see 3 of them on Amazon here) by working with my specialty society, so that is one opportunity to pursue when it comes to books. The easiest way to start writing books chapters is to find someone you know that is senior to you who already writes chapters and offer to be a co-author for the next edition. If you go to your department head/chair or residency director, they should be able to tell you who writes book chapters in the department.

- Case reports – This is the entry path to publishing and where I made most of my initial academic bones. Frankly, publishing case reports gotten me a lot of my academic reputation, fitrep impact in block 41, and subsequent promotion to O4 and O5. Nowadays, there are a lot of journals and it is easier than ever to get something accepted, especially if you are open to publishing cases on blogs or in newsletters.

- Humanities – Many journals regularly publish 1-2 page articles about the experience of being a physician, ethics, military medicine, and other related topics. A common way to get one of these published would be to deploy and then write a humanities piece while deployed or upon returning about your experience.

- Newsletters – I wrote a personal finance column in one of our specialty society newsletters for 7 years. If you can get a regular gig like this, it will force you to write on a regular basis and really build your CV and academic reputation. Every specialty has newsletters and “throw away” journals that arrive in the mail. Contact the editors, offer to write something, and see if this is something you enjoy.

- Podcasts – Similar to blogs, this is fairly easy to do with some free software (Audacity), a $50 USB microphone headset, a podcast host (I host on this blog’s WordPress site but here are other hosts out there), and the time to figure out how to post your content on the Apple store. Like blogging, it is very time consuming. Personally, it is not my favorite thing to do (which is why my podcast has lagged way behind) because I have zero interest in learning how to properly edit recordings, but there is nothing preventing you from getting your voice out there.

- Research manuscripts – If you want to do research, you should start with the Institutional Review Board (IRB) that your command is subject to. There will be resources available to help you, but in my experience it is a pull system (you have to inquire and go get them) and they are not pushed to you. Typically, you’ll find grant writers, statisticians, and sources of money to do research. You’ll also find additional military rules and regulations heaped on top of all of the already existing IRB rules and regulations. This latter fact is what dissuaded me from doing a lot of research in my academic career.

- Review articles – Most journals solicit authors to write review articles, so it is hard to get one accepted if it is unsolicited. That said, if you shorten it a bit by focusing on a more narrow topic and build it around a case presentation, you can get them accepted as case reports.

How to Build Your Academic Career in the Navy

What is the easiest way to build an academic career? It is simple but not easy. Not that many people follow through on it. Here are the steps:

- Obtain a USUHS faculty appointment – This blog post tells you how to do it.

- Progress toward promotion

This 2nd step is the step that most people fail to follow through on. They get appointed as an Assistant Professor, and then they stop working toward promotion to Associate Professor or full Professor.

In general, an Assistant Professor is a local/regional expert, an Associate Professor has established themself as a regional/national expert, and a full Professor has reached national or international acclaim. If you touch base with your USUHS department once a year and get their assessment about what steps you need to take to get promoted, you will be forcing yourself to progress in your academic career.

For example, I’m an Associate Professor of Military & Emergency Medicine and recently applied to be a full Professor. The feedback I was given was that I needed 3-4 more peer-reviewed publications as the first author. I may or may not choose to try and get them, but at least they gave me an honest assessment of what I needed to do. If you do this annually, you’ll get actionable feedback that you can address as you build your academic chops.

Asset Location

Here’s a tip on asset location from one of my favorite blogs and authors, Jonathan Clements from Humble Dollar:

After deciding what investments to buy, we should consider asset location. What’s that? It involves divvying up investments between taxable and retirement accounts. If investments generate large annual tax bills—think taxable bonds and actively managed funds—we’ll typically want to hold them in a retirement account.

Jonathan’s advice is the traditional advice. Put your taxable bonds, like the Thrift Savings Plan (TSP) F and G funds, into your retirement accounts. This is what I do. My F and G funds are in the TSP, clearly a retirement account, and my international bonds (which they don’t have in the TSP) are in an individual retirement account (IRA).

I don’t own actively managed funds, and I also don’t invest in real estate investment trusts (REITs), although I have in the past and I think about it pretty frequently.

There is another school of thought, though. The White Coat Investor has a different take. You can read about them in his posts entitled My Two Asset Location Pet Peeves and Bonds Go in Taxable!

Of note, just about everyone says to put actively managed funds or REITs in a retirement account, so you won’t find any arguments there.

If you’re really interested in this concept/discussion, the Bogleheads Wiki on tax efficient fund placement is a great read as well.

Military Health System Achievements in 2019 Provide Strong Foundation for Year Ahead

Here’s a link to this article from the Defense Health Agency:

Military Health System Achievements in 2019 Provide Strong Foundation for Year Ahead

Will the Government Ever Get Rid of the “Free Lunch” of the TSP G Fund?

They say there’s no free lunch, but in the Thrift Savings Plan there is a free lunch, and it’s called the G Fund. Will the government get rid of this free lunch?

The G Fund Free Lunch

What is this free lunch? You can read about it on this page in the Rewards section:

The G Fund interest rate calculation is based on the weighted average yield of all outstanding Treasury notes and bonds with 4 or more years to maturity. As a result, participants who invest in the G Fund are rewarded with a long-term rate on what is essentially a short-term security. Generally, long-term interest rates are higher than short-term rates.

The government is paying you a higher interest rate than it should. That is the G Fund free lunch.

Why is the Free Lunch at Risk?

The government periodically considers getting rid of it. For example, you can read about it in this article, which is discussing the President’s FY19 budget plan/request. Here’s the relevant portion:

The plan also proposes reducing the statutorily mandated rate of return for the government securities (G) fund to be based on either the three-month or four-week Treasury bill, at a projected savings of $8.9 billion over 10 years.

“G Fund investors benefit from receiving a medium-term Treasury Bond rate of return on what is essentially a short-term security,” the White House wrote. “The budget would instead base the G-fund yield on a short-term T-bill rate.”

TSP spokeswoman Kim Weaver said changing the G Fund’s yield, which is currently 2.75 percent annually, would have a disastrous effect on participants’ ability to save for retirement. If Congress changed the G Fund to track the three-month Treasury bill, the yield would decrease to 1.46 percent, and for the four-week bill it would drop to 1.43 percent.

“Such a change would make the G Fund inadequate and ineffective from an investment standpoint for TSP participants who are saving for retirement,” Weaver said in an email. “More than 3.6 million TSP participants (69 percent) have all or some of their account balance invested in the G Fund. Of those with money in the G Fund, 2 million (39 percent) hold the G Fund as their sole investment choice.”

For a TSP participant who has just retired and is invested entirely in the L Income Fund, which is designed for people who have begun taking annuity payments, they would run out of money at age 84 instead of the current projected age of 92, Weaver said.

Jessica Klement, staff vice president for advocacy at the National Active and Retired Federal Employees Association, said the change would make G Fund investments “useless” and likely force TSP administrators to divest from it entirely.

“[The new rate] would not even keep up with inflation,” she said. “So if you wanted to keep your money in a mostly secure fund, you would not be getting any return, and you’d actually be losing money. And if you took your money out, there would be no other safe, secure investment for those nearing or in retirement.”

What Does This Mean For You?

Right now, it means nothing. This is all just discussion about something that might happen in the future.

What you do need to understand, though, is that the G Fund serves a specific purpose in your portfolio. As the TSP site says:

Consider investing in the G Fund if you would like to have all or a portion of your TSP account completely protected from loss. If you choose to invest in the G Fund, you are placing a higher priority on the stability and preservation of your money than on the opportunity to potentially achieve greater long-term growth in your account through investment in the other TSP funds.

It is alarming that Ms. Weaver from the TSP said, “Of those with money in the G Fund, 2 million (39 percent) hold the G Fund as their sole investment choice.” Those 2 millions people are sacrificing long-term growth for the safest and most conservative investment available in the TSP.

There’s nothing wrong with that if you’re doing it because you are very conservative, near retirement, or the G Fund serves as the bond portion of a larger, more diversified portfolio that has more risky assets like stocks or real estate.

The sad reality is that most who are solely invested in the G Fund are that way because it used to be the default option for those starting a TSP account, and they never switched it to a more aggressive investment option. Under the new Blended Retirement System, the default investment switched from the G Fund to an age-appropriate Lifecycle fund.

What’s the Bottom Line?

The G Fund gives you a free lunch, paying you a higher long-term interest rate while you are investing in short-term securities. The government periodically talks about getting rid of that free lunch.

If you are invested in the G Fund, make sure you are doing it purposely and are aware of its conservative nature. Its emphasis is on preserving wealth rather than growing wealth.

Check Your Beneficiary Designations

Here’s a tip from one of my favorite blogs and authors, Jonathan Clements from Humble Dollar:

CHECK YOUR BENEFICIARY DESIGNATIONS. Your retirement accounts and life insurance will typically pass to the beneficiaries specified on those accounts, not the people named in your will. If your family situation has changed, or you simply don’t remember who you listed, take a moment to review your beneficiary designations.

Don’t let the ex-spouse get your money when you die! Update your beneficiaries.

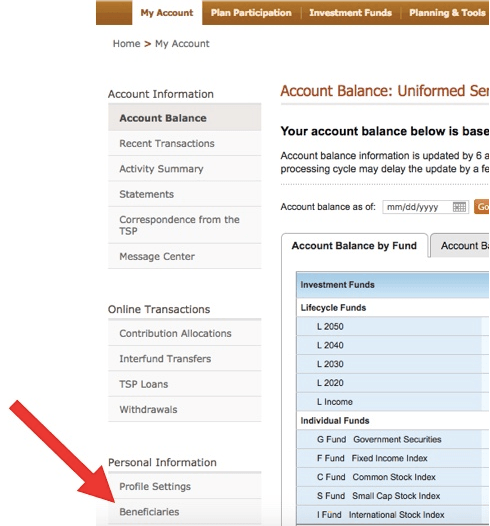

How to See Your Beneficiaries for the Thrift Savings Plan (TSP)

If you log on to the TSP page, you need to click on the link along the lower left, marked by the large red arrow:

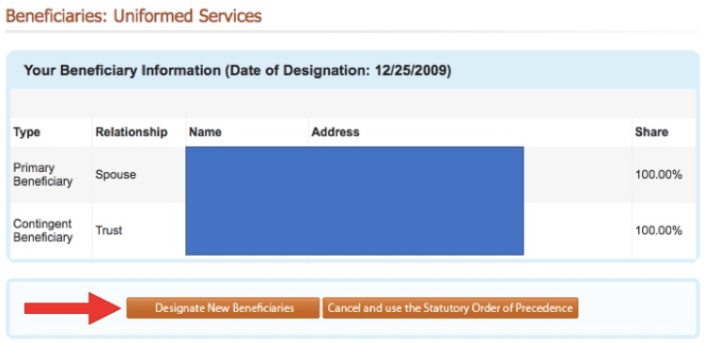

Then you’ll see this, and you can change them at the bottom:

Then you’ll see this, and you can change them at the bottom:

Invest in Your Taxable Account Thoughtfully

Here’s a tip on investing in your taxable account from one of my favorite blogs and authors, Jonathan Clements from Humble Dollar:

INVEST YOUR TAXABLE ACCOUNT THOUGHTFULLY. If you purchase the wrong investments in your taxable account, you may be reluctant to sell, because you’ll trigger capital gains taxes. A good choice: low-cost U.S. and international total stock market index funds, which should be tax-efficient—and which shouldn’t ever lag far behind the market averages.

For those of us in the military, investing in a taxable account comes into play in a few scenarios…

Scenario #1 – You and your spouse (if you have one) have filled your Thrift Savings Plan (TSP) and all other retirement accounts available including IRAs, yet you want to save more for retirement. In this case, you put the rest in a taxable account with the investment company of your choice (Vanguard, Fidelity, Schwab, etc.). This is what I do when all of my retirement accounts are full, and just like Jonathan mentions I invest purely in broad, low-cost index funds at Vanguard. The only taxable holdings I have are the Vanguard U.S. and international total stock market index funds.

Scenario #2 – You are saving for a financial goal that is not related to retirement, such as a downpayment on a home or for a new car. If you’re saving for college, you’d use a 529 plan, but for just about anything else you could use a taxable account. For example, I have my emergency money and extra spending money in a money market fund among my taxable accounts. The alternative to this is to use a bank and invest in a high-yield savings account, a certificate of deposit (CD), or a money market account. Bankrate.com will show you the best rates for each of these reasonable alternatives.

If you are using a taxable account, there are a few things to consider. If you are investing in bonds, you may want to invest in municipal bonds in your taxable account due to the tax benefits. If you are a fan of target date funds, you may not want to use them in a taxable account because the bond portion will kick off income that is taxed at your full marginal tax rate. Most feel that bonds are better placed in a tax-advantaged retirement account unless you are using municipal bonds.

Can You Now Sue the Military for Medical Malpractice?

Here’s a Navy Times article that answers that question:

Explainer: Can you now sue the military for medical malpractice?

MOAA – President Signs NDAA: What the Law Includes, and What’s Next

Here’s a link to this good NDAA summary:

President Signs NDAA: What the Law Includes, and What’s Next

Finance Friday Articles

Here are my favorites this week:

10 Things That Matter Most In Personal Finance

End of the Year Financial Checklist for High Earners

Here are the rest of this week’s articles:

7 Things to Learn From the Periodic Table of Investment Returns

Creating a Personal Finance Curriculum: 5 Questions

Big overhaul set for IRAs could be more or less taxing

Explaining the Different Types of Real Estate Crowdfunding Platforms

Eyes Forward – Saving vs Spending

How Did These Physicians Create Passive Income?

Joining a Cult: The Financial Independence Counterculture

Military spouses will get reimbursed up to $1,000 for professional relicensing costs

Real Estate Investing for Doctors

Retirement and 529 Changes from the SECURE Act

Six Months of Part-Time Work. Or How to Save $60,000 on Taxes.