Navy Implements Changes to Transition Assistance Program

From Chief of Naval Personnel Public Affairs

WASHINGTON (NNS) — Navy announced improvements to the Transition Assistance Program (TAP) in NAVADMIN 223/19, released Sept. 30.

The message outlines five key elements of the changes effective Oct. 1:

- Mandatory initial counseling/self-assessment to be completed 365 days or more prior to release from active duty.

- Assign Sailors to at least one of three pathways (Tier I, Tier II, & Tier III)

- Mandatory pre-separation counseling to be commenced 365 days or more prior to release from active duty as part of Day 1 of TAP class.

- Adjustment of Department of Labor Employment Workshop to one day vice three.

- Completion of one of four two-day tracks as part of day 4 and 5 of transition course.

- Documentation of TAP completion via DD Form 2648 in DMDC.

“Implementing these changes aligns the Navy with direction provided by the National Defense Authorization Act,” said Tom Albert, Navy TAP Manager, OPNAV N17 Competency and Compliance branch. “But more importantly, these changes offer a better individualized transition process to civilian life for our Sailors and their spouses.”

Under the three-tier system, Sailors preparing to leave the service will meet with a counselor to discuss their plans after separation or retirement. From there, they will be classified into one of three tiers.

“For Tier I Sailors, they don’t need as much as far as services. They’re pretty much engaged in their transition,” said Anthony Stevens, the military readiness section lead at Commander Naval Installations Command. “Many of them already have a job lined up, or they’re retiring.”

Service members in Tier II are ready to transition, but not yet fully prepared. In other words, they may be saving their money and looking into careers, but may even still be on the fence about staying in the service, he said.

Tier III service members, “Don’t have any plans whatsoever,” Stevens said. This could include service members who are being discharged under other-than-honorable circumstances or are leaving the service on short notice because of an injury or disability.

Once service members are funneled into one of the three tiers, the counselor recommends a specific track — either higher education, employment, entrepreneurship or vocational skills training — based on the person’s goals for life after the military.

TAP is mandatory for active and reserve personnel who serve 180 or more days of consecutive active duty and must be completed prior to release and issuance of DD214.

Sailor 2025 is the Navy’s program to improve and modernize personnel management and training systems to more effectively recruit, develop, manage, reward, and retain the force of tomorrow.

TSP Fund Deep Dive – The I Fund – The TSP’s Most Controversial Fund

There are only five investments available in the Thrift Savings Plan (TSP), so let’s take a detailed look at them one at a time. In this post we’ll cover the I Fund, which is the most controversial of all the TSP funds.

What’s all the controversy? You can read about it below, but to give you a preview it is because of two things.

First, investment experts disagree on how much of your investments should go into international stocks, which is what the I Fund is composed of.

Second, the I Fund misses out on a key portion of a comprehensive international stock portfolio, emerging markets. As you’ll read, this second point will soon be fixed.

Inception Date

1 MAY 2001

Fund Management

The Federal Retirement Thrift Investment Board currently contracts BlackRock Institutional Trust Company, N.A. (BlackRock) to manage the I Fund assets. The I Fund remains invested regardless of the performance of the securities markets or the overall economy.

Investment Strategy

The I Fund is invested in a stock index fund that invests in international stocks of more than 20 developed countries. The I Fund’s objective is to match the performance of the MSCI EAFE (Europe, Australasia, Far East) Index. Also, some of the money in the I Fund is temporarily invested in the G Fund and earns the G Fund return.

The I Fund is a passively managed fund that remains invested according to its indexed investment strategy regardless of stock market movements or general economic conditions.

What is the Risk?

Your investment in the I Fund is subject to market risk because the prices of the stocks it invests in rise and fall. You are also exposed to inflation risk, meaning your I Fund investment may not grow enough to offset inflation. Unlike the C or S Funds, you are also exposed to currency risk. What’s that? The TSP defines it as:

The risk that the value of a currency will rise or fall relative to the value of other currencies. Currency risk could affect investments in the I Fund because of fluctuations in the value of the U.S. dollar in relation to the currencies of the 22 countries in the EAFE index.

Because of its exposure to currency risk, the I Fund returns will rise or fall as the value of the U.S. dollar decreases or increases relative to the value of the currencies of the countries represented in the EAFE index.

What is the Benefit?

Historically, this increased risk has been rewarded with an increased return. It offers the opportunity to experience gains from equity ownership of international stocks of more than 20 developed countries. Here is all the performance data as of 29 SEP 2019:

Types of Earnings

The I Fund changes in value as the market price of its stocks change. In addition, the I Fund makes money for its investors when those stocks pay dividends. Unlike a traditional mutual fund, though, income from dividends is included in the share price calculation. It is not paid directly to participants’ accounts. Finally, the I fund will change in value due to currency risk, as described above.

It also makes some money on interest on short-term investments and securities lending income.

BlackRock credits interest and dividend income each business day. This income is then reflected in the TSP share prices.

Share Price Calculations

The value of your account is determined each business day based on the daily share price and the number of shares you hold. At the end of each business day, after the stock and bond markets have closed, the total value of the funds’ holdings (net of accrued administrative expenses) is divided by the total number of shares outstanding to determine the share price for that day. The daily change in TSP share prices reflects all investment income (interest on short-term investments, dividends, capital gains or losses, and securities lending income) net of TSP administrative expenses.

Expenses

The net expenses paid by investors is 0.041% or 4.1 basis points, which like all the TSP funds is ridiculously low and is a major benefit of the TSP. It cost $0.41 for each $1,000 invested.

How Should I Use the I Fund in my TSP Account?

The I Fund can be useful in a portfolio that also contains stock funds that track other indices, such as the C Fund (which tracks an index of large U.S. company stocks) and the S Fund (which tracks an index of small-medium U.S. company stocks). The C, S, and I Funds track different segments of the global stock market without overlapping. This is important because the prices of stocks in each market segment don’t always move in the same direction or by the same amount at the same time. By investing in all segments of the stock market (as opposed to just one), you reduce your exposure to market risk.

The controversy among investment experts, though, is how much of your stock portfolio should be invested internationally. You’ll find respected investment experts who recommend anywhere from 0% of your stocks being invested in international markets (like John Bogle, the founder of Vanguard) to about 50%. An extensive discussion on this can be found in Step 4 of our Crush the TSP Series – Invest. What’s the bottom line? Here is what I think…

A 40% international allocation is between the 0% Bogle viewpoint and the 50% global weighting viewpoint, so it seems fine to me and that is what I do. Ultimately, you can pick anywhere from 0% to 50% and find someone really smart who agrees with you. I’d encourage you to have some exposure to international, so I’d say you should pick at least 20%, but it really is up to you.

The I Fund can also be useful in a portfolio that contains bonds. Again, it is because the prices of stocks and bonds don’t always move in the same direction or by the same amount at the same time. So a retirement portfolio that contains a bond fund like the F Fund, along with other stock funds, like the C and S Funds, will tend to be less volatile than one that contains stock funds alone.

Advice from My Favorite Short Investing Book

Here is what my favorite investing book, The Elements of Investing: Easy Lessons for Every Investor, says about international stock funds like the I Fund:

We do believe that investors should combine one of the total U.S. stock market index funds with a total international stock market index fund.

How do you do this with the TSP? Well…you can’t, and that is why the I Fund is controversial.

If you want to invest in the total US stock market, you just combine the C Fund with the S Fund in a 3:1 ratio. To see how I use the S Fund, read the Crush the TSP series.

But you cannot invest in a total international stock market index fund in the TSP because the I Fund is its only international stock option and it does not invest in emerging markets. Emerging markets include some of the largest economies in the world, like China and India. You can read more about emerging markets here.

As part of upcoming changes to the TSP, the I Fund is switching its index to include emerging markets. They are going to be switching to the MSCI All Country World Index Ex-U.S. index. This index is broader and includes both developed and emerging markets.

Overall, this is a good thing. The current I Fund doesn’t provide worldwide stock representation, but the new one will. Original reports stated that the change was slated to take effect in early 2019, but as of SEP 2019 it has not occurred yet.

Once this change occurs, you’ll be able to use the TSP to invest in a total international stock market index fund because that is what the I Fund will be.

Finance Friday Articles

I highlight this article in particular because it discusses the latest info on disability insurance for military physicians:

Individual Disability Insurance: Back to the Basics (And Beyond)

Here are the rest of this week’s articles:

5 Steps to Winning at Personal Finance

7 Principles of Bond Investing

A Dozen Dumb Money Mistakes Doctors Make

A man who retired at 43 to travel says the biggest challenge will be mental, not financial

Auto Loans Stretch To Eight Years To Accommodate Irresponsible Car Buyers

Can a Year of Low Earnings Reduce My Social Security Benefit?

How To Ask For What You Want At Work… And Get It

Investing in Retirement: The 3 Big Issues

Mind the Trap of Financial Advisors

Mutual Fund Expenses — Back to Basics

Number of TSP Millionaires Still Growing

Quantifying the “Pediatrics Opportunity Cost”

Regret After Leaving a Medical Career Behind

The Cost of Waiting – Why It’s Better to Invest Conservatively Now Than to Average-In

The Federal Reserve’s Interest Rate Mandate

The Million-Dollar Question: How Much Is Enough to Retire?

The Top Tax-Free Investments Doctors Should Consider

What concert tickets can teach us about investing

Why Talking About Individual Stocks (and Sectors) Makes You Look Dumb

Why Didn’t LCDRs Promote on 1 OCT 2019?

LCDRs who were expecting to promote on 1 OCT 2019 did not see their names on the 1 OCT 2019 promotion NAVADMIN. Instead they saw:

PERMANENT PROMOTION TO LIEUTENANT COMMANDER

FY-20 Lieutenant Commander Line and Staff Corps Promotion Selection Boards

results are pending Senate Confirmation as of the preparation date of this

message.

Once the Senate confirms the selections, the names will show up on a forthcoming NAVADMIN and the pays and promotions will be back dated. There isn’t anything people can do except wait.

Throwback Thursday Classic Post – How Valuable is a Military Pension?

(Enjoy this always relevant re-post.)

Two recent events led to this post. First, this article about becoming a multimillionaire in the military appeared on military.com. Second, I was having a discussion with some other officers about this topic and they thought my opinion on the subject was different from what they had heard before. Because of this, we’re going to examine the value of a military pension.

How Much of a Pension Do You Get?

Let’s look at two likely scenarios for a physician. First, someone who stays in for 20 years and retires as an O-5. Second, someone who stays in for 30 years and retires as an O-6. Their pensions in today’s dollars based on this calculator would equal approximately:

20 year O-5 = $4,102.50/month or $49,230/year

30 year O-6 = $8,053.50/month or $96,642/year

Remember that your military pension payments are adjusted annually for inflation, a very valuable benefit.

How Much is This Worth?

The easiest way to answer this is to examine the pension and figure out how much money you’d need to have invested in order to pay yourself exactly the same amount of money inflation adjusted for the rest of your life. Unfortunately, this is not a simple issue.

Military.com Article “Can Military Service Make You a Millionaire?”

The aforementioned military.com article states, “The Defense Department puts the value of the monthly check of an O-6 retiring today with 30 years of service at $2.2 million…The DoD made a number of assumptions, but the idea was to put a price tag or value on the monthly military retirement check a military retiree will receive.” This article doesn’t go into the assumptions made, but let’s just take it at face value.

My MBA Finance Professor

In 2013 when I was taking my MBA, I asked my Finance professor this very question. I asked him how he would value a 21 year O-6 pension, another common circumstance for a physician. At the time this pension was approximately $53,400/year. Here is what he said:

“If you looked at this as an ‘endowment’ where one would not spend the principal, then take the annualized benefit $53,400 ($4,455 x 12) and divide by a long-term rate such as the 30 year T-Bond rate (3% in 2013) $1,782,000. In other words, if you had that $1,782,000 and put it all into 30 year T-Bonds at 3% you would get your $4,455/month. Of course, the issue is whether the 3% is a good number for the long-term. If, however, you were to look at this as an ‘annuity’ where you would spend down the principal until time of death, then you have all sorts of demographic stats issues (e.g., expected life after retirement, future interest rates, variability of the annuity investment, cost of living adjustments, etc.). In a nutshell, it can get quite complex. There are a number of websites available often through reputable firms such as Fidelity, Vanguard, etc., that you can perhaps access that have such calculations available already (instead of having to create your own model). You can plug in your what if’s and see what pops out.”

Using the 30 year T-bond (Treasury bond) rate from 3/18/16, which was 2.68%, here is the valuation with his methodology:

20 year O-5 = $49,230/2.68% = $1,836,940

30 year O-6 = $96,642/2.68% = $3,606,044

The problem with this analysis is that a regular 30 year T-bond is not inflation adjusted, so in my opinion you’d have to compare it to TIPS (Treasury Inflation Protected Securities). A recent yield on a 30 year TIPS bond is 1.12%, which would value the two pensions we’re considering at:

20 year O-5 = $49,230/1.12% = $4,395,536

30 year O-6 = $96,642/1.12% = $8,628,750

Keep in mind that the lower the Treasury bond yields go, the more valuable your pension is because you’d have to invest more money to get the same payout. Since today’s Treasury yields are at historic lows, these valuations are probably as high as they’ll ever get.

Annuity Websites

If you go to annuity websites and try to purchase an annuity for these two amounts, here is how much they would cost:

Fidelity Guaranteed Income Estimator:

For a 20 year male O-5 who is 50 years old, lives in Virginia, and wants to earn $4,103/month or $49,236/year with a 2% annual income increase (equivalent to the inflation adjustment of your military pension) the pension would cost $1,322,826.

For a 30 year male O-6 who is 60 years old, lives in Virginia, and wants to earn $8,054/month or $96,648/year with a 2% annual income increase (equivalent to the inflation adjustment of your military pension) the pension would cost $2,103,257.

The 4% Rule

The 4% rule is a commonly accepted retirement “rule” that says you can take 4% out of your retirement nest egg every year, annually adjusted for inflation, and never run out of money. In other words, for every $40,000/year of income you need in retirement, you need to have $1 million saved for retirement. Whether the 4% rule is valid in today’s low yield environment has been debated, but let’s just assume it is still valid (because I think it is).

If you divide the annual military pension by 4% it would give you the size of the nest egg you’d need to withdraw that amount:

20 year O-5 = $49,230/4% = $1,230,750

30 year O-6 = $96,642/4% = $2,416,050

Keep in mind that your government pension is guaranteed by the federal government but the assets used in the typical application of the 4% rule, like your retirement accounts and other assets, are not, making your pension a much safer bet that is probably worth more than the numbers above.

Unquantified Value

There is some value in the military pension that people tend to underestimate. First, it is guaranteed by the US government, which makes it “risk free”. The only option discussed above that would offer this same value is the valuation comparing the pension to Treasuries. Even an annuity from an insurance company is not risk free because insurance companies do go out of business. (I will admit, though, that this is a rare event, and you could diversity by purchasing annuities from multiple companies, so an annuity can be pretty close to “risk free”.)

Second, you can’t screw it up. Investors are their own worst enemy. They buy high, sell low, trade too frequently, don’t save enough, over estimate how high their returns will be, pay excessive investment fees, and other errors that can very easily screw up your well planned retirement. You can not screw up your military pension.

Third, some states don’t tax a military pension. You can find that info here on-line or here in PDF form.

Fourth, and this benefit is HUGE for me. I see my military pension as equivalent to a massive pile of TIPS. This allows me to take much more risk with the remainder of my investment portfolio and net worth. How much risk? Overall my asset allocation is 90% in stocks, which is a lot more risk than most people would recommend at my age of 40. Because of my pension, though, I don’t think I’m taking too much risk.

The Bottom Line

As you can see, a military pension is risk free, inflation adjusted, and can be quite valuable. Can you make more money as a civilian, save well, and accumulate even more than this? Yes, but this is all determined by your civilian salary, discipline as an investor, and rate of return on your investments, which no one knows since they can’t predict the future. A military pension is a very valuable and underappreciated financial asset that is probably worth somewhere between $1,200,000 and $2,500,000, depending on how long you stay in and what rank you achieve. If you try to match the risk with Treasury bonds at today’s rates, it is worth a lot more.

Electronic Submission of Letters to the Board Now Available

From Navy Personnel Command Public Affairs

MILLINGTON, Tenn. (NNS) — The Navy has announced a new online capability that allows board-eligible Sailors to submit letters to the board (LTBs) electronically, Sept. 27.

Announced in NAVADMIN 220/19, the Electronic Submission of Selection Board Documents (ESSBD), is a MyNavy HR transformation and Sailor 2025 initiative designed to improve personnel programs and give Sailors more control and ownership over their careers. ESSBD improves the speed, transparency and confidence of receipt over current submission methods.

The application allows board candidates the ability to submit pre-formatted LTBs, with or without attachments. Additionally, board candidates are able to view the exact product that will be delivered to the board. Previous submission methods (U.S. Postal Service, e-mail, etc.) will remain, but ESSBD will become the preferred LTB submission method.

ESSBD will be available for limited use by administrative boards through the remainder of calendar year 2019. For a list of eligible boards (none of which appear to be medical to me – JMS) and their convening dates, consult NAVADMIN 220/19. Beginning Jan. 1, 2020, ESSBD will be available for all promotion, advancement and selection boards.

ESSBD is currently available for submissions of LTBs only. Submissions to application-driven boards and programs, such as Limited Duty Officer/Chief Warrant Officer (LDO/CWO), Lateral Transfer, educational programs, etc. will not be submitted via ESSBD. Sailors should continue to use the submission guidance contained in the specific NAVADMINs for these programs.

To use ESSBD, candidates must access document services through MNP at https://www.mnp.navy.mil/group/my-record. Submitters should have all information, with attachments (if applicable), prior to beginning this process, as there is currently no “save-and-return” function between BOL sessions. Submitters will receive an email confirmation of receipt. Submission and subsequent receipt acknowledgement for letters submitted via ESSBD, or other means, does not constitute confirmation of board eligibility.

A full visual user guide is available at https://www.public.navy.mil/bupers-npc/boards/selectionboardsupport/Documents/ESSBDUSERGUIDE_v4.pdf.

For more information or questions related to ESSBD and ESSBD submissions, consult NAVADMIN 220/19 or contact the MyNavy Career Center (MNCC) by calling (833)-330-6622, or via DSN at 882-6622.

Two Messages from the Navy Surgeon General About Today’s MTF Transition and Navy Medicine Readiness & Training Commands

Here is a link to the video that explains the transition that happened today:

https://dod.defense.gov/News/Special-Reports/Videos/?videoid=711683

Here is a link to an article the SG wrote in Navy Times:

Authorized Boot Listing for NWU Type IIIs

Since today is the last day you can wear your beloved “blueberries,” here is the listing of boots you can wear with your NWU Type IIIs:

Thrift Savings Plan Fund Deep Dive – The S Fund

There are only five investments available in the Thrift Savings Plan (TSP), so let’s take a detailed look at them one at a time. In this post we’ll cover the S Fund. You can combine the S Fund with the C Fund to invest in the entire US stock market.

Inception Date

1 MAY 2001

Fund Management

The Federal Retirement Thrift Investment Board currently contracts BlackRock Institutional Trust Company, N.A. (BlackRock) to manage the S Fund assets. The S Fund remains invested regardless of the performance of the securities markets or the overall economy.

Investment Strategy

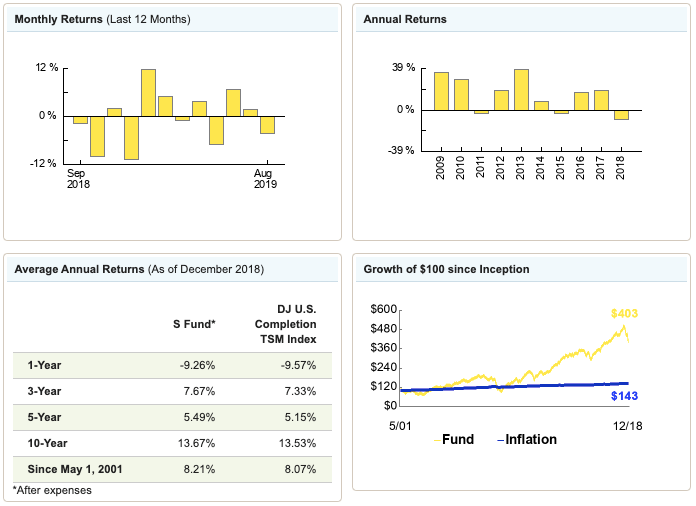

The S Fund is invested in a stock index fund that invests in small to medium-sized U.S. companies that are not included in the C Fund. The S Fund’s objective is to match the performance of the Dow Jones U.S. Completion TSM Index, which means that when you combine the S Fund and C Fund you are investing in the entire US stock market. Also, some of the money in the S Fund is temporarily invested in the G Fund and earns the G Fund return.

The S Fund is a passively managed fund that remains invested according to its indexed investment strategy regardless of stock market movements or general economic conditions.

What is the Risk?

Your investment in the S Fund is subject to market risk because the prices of the stocks it invests in rise and fall. You are also exposed to inflation risk, meaning your S Fund investment may not grow enough to offset inflation.

What is the Benefit?

Historically, this increased risk has been rewarded with an increased return. It offers the opportunity to experience gains from equity ownership of small and medium-sized US company stocks. Here is all the performance data as of 26 SEP 2019:

Types of Earnings

The S Fund changes in value as the market price of its stocks change. In addition, the S Fund makes money for its investors when those stocks pay dividends. Unlike a traditional mutual fund, though, income from dividends is included in the share price calculation. It is not paid directly to participants’ accounts.

It also makes some money on interest on short-term investments and securities lending income.

BlackRock credits interest and dividend income each business day. This income is then reflected in the TSP share prices.

Share Price Calculations

The value of your account is determined each business day based on the daily share price and the number of shares you hold. At the end of each business day, after the stock and bond markets have closed, the total value of the funds’ holdings (net of accrued administrative expenses) is divided by the total number of shares outstanding to determine the share price for that day. The daily change in TSP share prices reflects all investment income (interest on short-term investments, dividends, capital gains or losses, and securities lending income) net of TSP administrative expenses.

Expenses

The net expenses paid by investors is 0.040% or 4 basis points, which like all the TSP funds is ridiculously low and is a major benefit of the TSP. It cost $0.40 for each $1,000 invested.

How Should I Use the S Fund in my TSP Account?

The S Fund can be useful in a portfolio that also contains stock funds that track other indexes such as the C Fund (which tracks an index of large U.S. company stocks) and the I Fund (which tracks an index of international stocks). The C, S, and I Funds track different segments of the overall stock market without overlapping. This is important because the prices of stocks in each market segment don’t always move in the same direction or by the same amount at the same time. By investing in all segments of the stock market (as opposed to just one), you reduce your exposure to market risk.

The S Fund can also be useful in a portfolio that contains bonds. Again, it is because the prices of stocks and bonds don’t always move in the same direction or by the same amount at the same time. So a retirement portfolio that contains a bond fund like the F Fund, along with other stock funds, like the C and I Funds, will tend to be less volatile than one that contains stock funds alone.

Advice from My Favorite Short Investing Book

Here is what my favorite investing book, The Elements of Investing: Easy Lessons for Every Investor, says about small and mid-cap funds like the S Fund:

The S&P 500 [C Fund in the TSP] represents only about 70 percent of the total value of all stocks traded in the United States. It excludes the 30 percent made up of smaller companies [which are in the S Fund], many of which are the most entrepreneurial and capable of the fastest future growth.

If you want to invest in the entire US stock market, you just combine the C Fund with the S Fund in a 3:1 ratio. To see how I use the S Fund, read the Crush the TSP series.

September Message from the Assistant Secretary of Defense for Health Affairs

from the Assistant Secretary of Defense for Health Affairs, HON Thomas McCaffery

MHS Team:

It’s a momentous time for the Military Health System. Earlier this month, the Defense Health Agency held its Change of Responsibility ceremony to bid farewell to VADM Rocky Bono and welcome LTG Ron Place as the DHA’s new leader. VADM Bono’s leadership during her four years with the DHA prepared the Agency for significant organizational reform that will enhance our integrated system of readiness and health and deliver on our mission to support the warfighter and care for the patient.

LTG Place brings 29 years of outstanding leadership and expertise including extensive surgical training, combat surgical experiences in Afghanistan, deployments during Operation Iraqi Freedom and Kosovo, commanding Army hospitals at all levels, and most recently as the National Capital Region medical director. His experience leading the transitional Intermediate Management Organization to oversee MTFs that transitioned to the DHA last year will be invaluable in helping foster the critical relationships between the DHA and Military Treatment Facilities.

I also would like to welcome Brig Gen Paul Friedrichs as the new Joint Staff Surgeon. Brig Gen Friedrichs has a wealth of experience as well. In his last assignment as Command Surgeon, Headquarters, Air Combat Command at Joint Base Langley-Eustis, he was responsible for organizing, training, equipping and sustaining combat-ready medical forces for rapid deployment. He was also responsible for the health care of 81,000 active duty and civilian personnel located at 12 bases and more than 300 operating locations worldwide.

And congratulations to MG R. Scott Dingle for his nomination for promotion to lieutenant general and assignment as the U.S. Army Surgeon General.

On the subject of change, years of planning are coming to fruition as we reach historic MHS milestones this month and next. These achievements are a direct result of your diligent work and commitment to delivering on key initiatives to support readiness and quality health care delivery. On September 7, the MHS’s new electronic health record, MHS GENESIS, went live at four new sites: Travis AFB, Presidio of Monterey, and Naval Air Station Lemoore in California, and Mountain Home AFB, Idaho. Together, these four sites make up “Wave Travis” – the first wave of post-Initial Operating Capability (IOC) full-scale deployment as we roll out this state-of-the- art integrated electronic health record system-wide.

MHS GENESIS is transformative for our enterprise, for our providers, and for our patients – enabling access to robust information about patients and better management of chronic, complex, and time-sensitive conditions. It also provides real-time clinical decision support, increases patients’ direct communication with providers, and helps the Military Health System better target and tailor resources to meet readiness requirements both for the medical force and the warfighter.

The Wave Travis deployment reflects a strategic and deliberate application of lessons learned during IOC testing in the Pacific Northwest, including improvements to our training strategy, change management process, and infrastructure support. With plans underway to complete worldwide MHS GENESIS deployment by 2024, we are already seeing this complex effort contribute to the broader MHS reform vision – including enhanced cybersecurity, standardized workflows, and improved patient engagement through the MHS GENESIS Patient Portal. A big shout-out to the teams at Travis, Presidio of Monterey, Lemoore, and Mountain Home, for your agility, preparation, and commitment to a successful deployment of MHS GENESIS!

A quickly approaching milestone for MHS transformation is the transfer of authority, direction and control of U.S. Military Treatment Facilities to the DHA on October 1. This pivotal change consolidates the management of MTFs under the DHA, thus advancing standardization, improving readiness, enhancing consistency in patient access and experience, reducing operating costs, and strengthening performance management systems. The end result will be a better system of military medicine – a truly integrated enterprise that optimizes medical readiness and patient care. While this is a big change, there should be no disruption to the daily routine at MTFs both for patients and staff. The conditions-based, direct-support framework that the DHA and the services will use to support MTFs as DHA stands up its headquarters capabilities will ease the transition.

Switching gears, on the topic of support to our warfighters, earlier this month I had the pleasure of meeting with VADM Tim Szymanski, Deputy Commander, U.S. Special Operations Command. We discussed DoD’s Comprehensive Strategy for Warfighter Brain Health, which aims to promote and protect the health and well-being of our forces, including optimizing cognitive performance and enhancing the Department’s capabilities to prevent, diagnose, and treat Traumatic Brain Injury. I’m so impressed with the initiative SOCOM has taken to be more preemptive in their approach, specifically, their Cognitive Surveillance Program, which is designed not only to identify injuries earlier, but also to track individual trends and assist in developing comprehensive treatment plans for a warrior’s recovery. In addition to taking a more deliberate approach to increasing awareness of potential cognitive issues, SOCOM provides initial baseline screening to its special operators, and retests them every two years to determine if there are significant changes. It’s the cognitive equivalent of a routine dental exam or audiogram. Cognitive Surveillance is actively driving the science through blast-exposure research efforts. By determining heavy weapons/breaching exposure levels, they can determine mitigation requirements. SOCOM’s approach is similar to what the Navy did when it created dive tables, which regulate scuba divers’ time underwater to prevent them from absorbing too much nitrogen and getting decompression sickness. With our operational commanders focused on brain health, I know that together, we can leverage innovation, research and development, and enhanced clinical programs to ensure our forces remain both lethal and resilient.

Lastly, I want to take a moment to recognize National Suicide Prevention Month and encourage you to come together to prevent and respond to the devastating trend of suicide. We all have a role to play in creating environments that empower each other to seek support early. Learn about the resources available if you or a friend needs help, and together, commit to build a culture of connectedness. I was heartened to read an inspiring story just last week about Airmen 1st Class Brittany Wright and Tiffany Duffus, two dental lab technicians at Peterson Air Force Base, Colorado. They stepped in to support a friend in need, embodying the team approach to resiliency and suicide prevention necessary to combat this tragedy in our ranks. Senior leadership across the MHS and the Department are committed to fostering a community and culture of support and access to the right help at the right time. For suicide prevention resources, visit https://health.mil/Military-Health-Topics/Conditions-and-Treatments/Mental-Health/Suicide- Prevention.

Tom