Uncategorized

Throwback Thursday Classic Post – How to Find Out Your Reporting Senior’s Fitrep Trait Average

One of the most important markers of a good fitrep is that your trait average is above your reporting senior’s trait average. Since most officers initially write their own fitrep and create their own trait average on the first draft, it is important to find out your reporting senior’s trait average so that you can try to be above it. Here are a few ways to find out what it is.

First, in order to have a trait average, your reporting senior has to have served as the reporting senior for officers of your same rank from any corps. If they have not done this, they’ll have no pre-existing average. For example, if you are a LCDR, your reporting senior does not have to have ranked LCDR physicians. If he/she has ever ranked a LCDR of any kind (nurse, line officer, etc.), then they will have an average.

If they have an average, here are the ways I know of to find it:

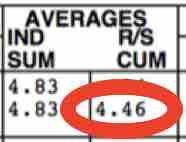

- If you’ve already received a fitrep from them in your current grade, then you can look at your Performance Summary Report or PSR, which you download from BUPERS On-Line. The number in the lower right in the “AVERAGES” column (circled below) is their average for that rank.

- If you haven’t received a fitrep from them, maybe you have a friend in the same rank who has received a recent fitrep from them. You can look at their PSR if they’ll let you.

- You can ask your chain of command or command fitrep coordinator. They often know because they are trying to make sure that all of the fitreps being done don’t change the reporting senior’s average in ways he/she doesn’t want.

- You can ask the reporting senior. They just may tell you.

The bottom line is that if you are drafting your fitrep, you want to try and find out the average and grade yourself above it. In the end, the ranking process may move you below it, but by submitting the draft with an above average grade you may increase the chances you stay above it.

FY20 War College Cheat Sheet

Everyone should try to get Joint Professional Military Education (JPME), especially in our new operationally focused environment. To assist you, here is the FY20 War College Cheat Sheet:

FY20 War College Cheat Sheet (Final)

I also added it to the Useful Documents page.

If you want more info about JPME, you can go to this page at Navy Personnel Command.

Global Health Specialist Program Information Package

We have put out a lot of Global Health Engagement (GHE) opportunities lately. You can see all of them past and present at this link. Many officers are wondering how they can get the GHE additional qualification designator (AQD).

Here is a information package that explains the entire program, including how to get the AQD:

Assistant Deputy Chief, M2 – Research & Development at BUMED – O5/O6

BUMED is looking for an O-5/O-6 to fill the Assistant Deputy Chief for Research and Development (M2) position in June of 2020.

CAPT Matthew Lim is the incumbent and his contact is in the global address book for questions. Here’s some additional info, if interested:

Assistant Deputy Chief Research and Development M2

Interested candidates should submit their CV and Bio to CDR Melissa Austin (also in the global) NLT 27 November with Detailer/Specialty Leader concurrence that you are eligible to PCS.

Navy Times – Prognosis Good for Navy Medicine, But Budget Concerns Loom

Here’s a link to this article:

2 Important TSP Changes and Finance Friday Articles

This week I’d like to highlight the 2020 TSP contribution limits, which will be $19,500 for most of us, as well as the instructions for enabling 2-factor login, which will be required as of 1 DEC:

TSP Contribution Limits for 2020

TSP 2-Factor Login Instructions

Here are the rest of the articles:

2020 Tax Brackets, Standard Deduction, and Other Changes

6 Bare Minimum Tasks to Fix Your Finances

Are Real Estate Investments Resistant to Inflation?

Bernstein Says Stop When You Win The Game

Financial Burdens and Physician Burnout

How to manage money for financial success in the U.S. military

How to Think About Money: A Physician on Fire Review

Into a Cloud – Letters from a Downed World War II Pilot

Lessons Driving an $800 Car Can Teach Your Kid

Non-Intuitive Lessons From the Man Who Solved the Market

Student Loan Planner Reviews: Honest Opinions from Three Former Clients

The 3 benefits of charitable giving

The Price of US Stocks and Signal Failure

Trends That Matter in Asset Management

TURNKEY RENTALS DON’T HELP YOU ACHIEVE FAST FIRE

Using Your Estate Plan to Have a Graceful Exit

What does buying a new car really cost over the years?

Why are Doctors Burning Out? Three Ways FIRE Can Save Us

Why Timing the Market is a Fool’s Errand

I’m Speaking at the Professional Development Committee Discussion on “The Future of Military Medicine” – NMCP – 14 NOV – 1200-1315

Here’s the info sent out about this panel I’ll be speaking at:

We are one week away from our incredible panel brought to you by the Professional Development Committee on the vital topic, “The Future of Military Medicine”. Our panel has adjusted slightly, but we have just an incredible trio that will be present to discuss the important topics on everyone’s mind as we find our course forward in military medicine. Our very own CO, CAPT Lisa Mulligan, will still be on our panel and will be joined by CAPT Guido Valdes, Deputy Commander of Navy Medicine East, as well as CAPT Joel Schofer, Deputy Chief of the Medical Corps from BUMED. This great, high-powered group will be giving us insight into ways forward from the BUMED, NME, and Command level. We look forward to seeing you all there! Tell your friends. VTC info below.

Conference Name: The Future of Military Medicine

Conference Date: Thursday, November 14, 2019

Conference Location: Auditorium, Building 3, NMC Portsmouth

Here’s a PDF announcement as well:

My Investment Portfolio

I write a lot about personal finance. If you are wondering what I’m doing for my own finances, here’s a detailed look at my own portfolio. I’m not going to give you dollar amounts, but percentages. If you want to know the dollar amounts, they can be expressed in one word. I have…enough:

At a party given by a billionaire on Shelter Island, Kurt Vonnegut informs his pal, Joseph Heller, that their host, a hedge fund manager, had made more money in a single day than Heller had earned from his wildly popular novel Catch-22 over its whole history. Heller responds,“Yes, but I have something he will never have . . . enough.”

Assets

My financial assets from largest to smallest include: (all percentages are rounded to the nearest whole percentage)

- 24% – My taxable mutual funds, which is where I put our retirement savings when I fill our retirement accounts. It is currently invested in:

- 56% – Vanguard Total Stock Market Index Fund Admiral Shares (VTSAX)

- 37% – Vanguard Total International Stock Index Fund Admiral Shares (VTIAX)

- 7% – Vanguard Prime Money Market Fund Investor Shares (VMMXX)

- 21% – My Thrift Savings Plan (TSP) – Currently invested in this proportion:

- 91% – US stocks

- 75% – C Fund

- 25% – S Fund

- 1% – International stocks (I Fund)

- 9% – US bonds split evenly between the G Fund and F Fund

- 91% – US stocks

- 15% – My paid off house.

- 12% – My wife’s TSP, which is invested 100% in US bonds with a 50/50 split of the G and F Funds.

- 12% – My wife’s Roth IRA, which is invested in:

- 53% – Vanguard Total International Stock Index Fund Admiral Shares (VTIAX)

- 47% – Vanguard Total International Bond Index Fund Admiral Shares (VTABX)

- 9% – We have two 529 plans with Vanguard invested in their aggressive age-based portfolio.

- 6% – My Roth IRA, which is 100% invested in the Vanguard Total International Stock Index Fund Admiral Shares (VTIAX).

- 1% – My wife’s individual 401k, which is 100% invested in the Vanguard Total International Stock Index Fund Admiral Shares (VTIAX).

- 1% – My wife has a 401k that is invested in the Fidelity® 500 Index Fund (FXAIX).

Liabilities

None. Aside from credit cards we pay off every month, we’re debt free.

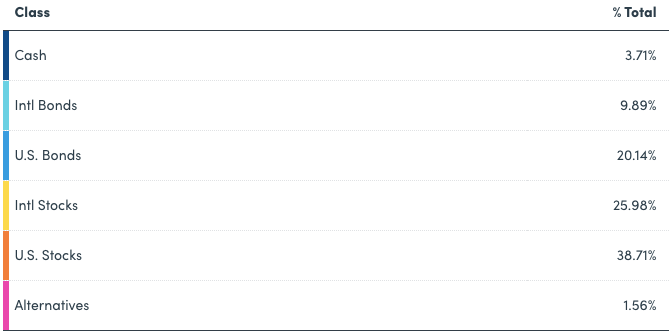

Overall Asset Allocation

Excluding the pension and my house, here’s my overall asset allocation courtesy of our favorite tool that made all of this easy, Personal Capital: