Retirement

Opt-In to Blended Retirement System NAVADMIN

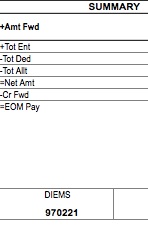

Below is the Blended Retirement System (BRS) NAVADMIN that just came out. If you are one of the people who can choose between the current system and the BRS, you can read what I think about it here. Active duty are opt-in eligible if their Date of Initial Entry into Military Service (DIEMS) is on or before 31 December 2017 and they have less than 12 years of service as of 31 December 2017. You can find your DIEMS on your LES on the right-hand side. Here is an image of my LES where you can see my DIEMS is February 21, 1997:

Because I have more than 12 years of service, I am not opt-in eligible and have to stay with the current system (thankfully).

Bottom line…stay with the current system if you are staying in for 20 years.

UNCLASSIFIED

ROUTINE

R 281546Z NOV 16

FM CNO WASHINGTON DC

TO NAVADMIN

INFO CNO WASHINGTON DC

BT

UNCLAS

PASS TO OFFICE CODES:

FM CNO WASHINGTON DC//N1//

INFO CNO WASHINGTON DC//N1//

NAVADMIN 259/16

MSGID/GENADMIN/CNO WASHINGTON DC/N1/NOV//

SUBJ/NOTIFICATION OF ELIGIBILITY TO OPT-IN TO THE BLENDED RETIREMENT SYSTEM//

REF/A/DOC/NDAA/13APR15//

REF/B/MSG/CNO WASHINGTON DC/271444ZSEP16//

REF/C/MSG/COMNAVPERSCOM MILLINGTON TN/151015ZAUG16//

NARR/REF A IS SECTIONS 631 THROUGH 635 OF NATIONAL DEFENSE AUTHORIZATION ACT,

SUBTITLE D – DISABILITY PAY, RETIRED PAY, AND SURVIVOR BENEFITS.

REF B IS NAVADMIN 217/16, ANNOUNCEMENT OF THE BLENDED RETIREMENT SYSTEM FOR

THE UNIFORMED SERVICES.

REF C IS A GENADMIN, PAY AND PERSONNEL INFORMATION BULLETIN 16-12.//

RMKS/1. This NAVADMIN is the official notification of eligibility to opt-in

to the Blended Retirement System (BRS) in accordance with references (a) and

(b).

2. Reference (a) states all Service members with a Date of Initial Entry

into Military Service (DIEMS) on or before 31 December 2017 are automatically

grandfathered under the current retirement system. However, some Service

members are eligible to opt-in to the BRS.

(a) Active component members are opt-in eligible if their DIEMS is on or

before 31 December 2017 and they have less than 12 years of service as of 31

December 2017, based on their Pay Entry Base Date.

(b) Reserve component members, to include Full-Time Support members, are

opt-in eligible if their DIEMS is on or before 31 December 2017 and they have

accumulated fewer than 4,320 retirement points as of 31 December 2017.

(c) United States Naval Academy, Reserve Officer Training Corps

Midshipmen and Delayed Entry Program members are opt-in eligible if their

DIEMS is on or before 31 December 2017.

3. The window for opt-in eligible members to enroll in BRS will be open from

1 January 2018 until 31 December 2018. Opt-in eligible Service Members must

be in a paid status at the time of enrollment. Service Members who meet the

criteria above but are not in a paid status during the election window, will

be given an opportunity to enroll during their first period of paid status.

Hardship extensions to the enrollment window for opt-in eligible Service

Members who are unable to enroll in BRS during the 2018 enrollment period

will be considered on a case by case basis in line with reference (a). If a

Service Member chooses to opt-in, their decision is irrevocable. Whether you

choose to opt-in or not, all Service Members who are opt-in eligible must

complete the Blended Retirement System Opt-In Course.

4. Commands must notify all opt-in eligible Service Members within their

command. Command administrative departments should also contact their

personnel support divisions on a regular basis to access a list of all opt-in

eligible Service Members within their command. Additionally, those opt-in

eligible Service members who have an up-to-date email address in Navy

Standard Integrated Personnel System in line with reference (c) will receive

notification of opt-in eligibility via e-mail.

5. All Navy commands must ensure that opt-in eligible Service Members

complete the Blended Retirement System Opt-In Course. This course will be

available in January 2017 on Joint Knowledge Online and Navy E-learning.

Although this course will be accessible by all Service Members, completion no

later than 31 December 2017 is mandatory for all opt-in eligible Service

Members. Additionally, command financial specialist can provide support for

unit-level basic financial literacy and BRS education. More robust financial

counseling services are available through personal financial managers at your

local Fleet and Family Support Center or online via a Military OneSource

personal financial counselor.

6. The importance of the decision to enroll in BRS or remain in the current

retirement system cannot be overstated. This decision is among the most

important financial decisions an opt-in eligible Service Member may make. I

am depending on an all-out leadership effort to ensure that the training is

completed and Service Members are making the most informed financial decision

possible.

7. This NAVADMIN remains in effect until superseded or cancelled, whichever

comes first.

8. Released by Vice Admiral R. P. Burke, N1.//

BT

#0001

NNNN

UNCLASSIFIED//

The New Blended Retirement System

There has been a lot of recent activity surrounding the new Blended Retirement System (BRS), and I don’t intend to reinvent the wheel and explain the whole system to you when there are some nice resources that already exist:

Military OneSource BRS Frequently Asked Questions

What I intend to do is give you a bottom line recommendation if you have a choice about using the current retirement system or going with the BRS.

If you know you are going to resign before you are eligible for retirement, you should select the BRS. Under the current system, you would get no retirement benefit, so that is a no-brainer.

If you are not sure how long you are going to stay in the Navy, you’ll have a tough decision to make. I’d read the above resources but also check out this article that discusses how flawed the BRS is:

New Military Retirement System Has Major Flaw

If you know you are going to stick around long enough to be eligible for retirement, my personal opinion is that you should choose to stay with the current retirement system. There are a few reasons for this:

- The BRS shifts risk from the government to you. We buy insurance when there is a risk that we can’t bear ourselves. People buy health insurance because a huge hospital bill could financially ruin them. We buy life and disability insurance because if a breadwinner died or was disabled in our household we wouldn’t have enough money to continue our desired lifestyle. The current government pension system is like retirement insurance. When it comes to retirement, the largest financial risk you run is that you outlive your financial assets. Social security insures against that, but so does your military pension, which regular readers know I highly value. Although the BRS has a pension as well, it is reduced, shifting more of this risk to you.

- Shifting risk to yourself is fine if you invest diligently and aggressively and the market earns a decent return. The problem is that most people don’t invest diligently or aggressively and no one knows what the market return will be over the next 10, 20, or 30 years. There are many people who lack the financial education they need (go here or here to get it) and invest in the Thrift Savings Plan but keep their money in the default option when you sign up, the G Fund. There is nothing wrong with the G Fund and I have some of my own retirement assets invested in it, but it is not designed to earn a high return. It is designed to not lose money and beat inflation. In order to benefit from the extra TSP money that comes with the BRS, you have to earn a high return and will need to be smart enough to invest in something more aggressive than the G Fund.

- If you control your spending, live in a reasonable house, and drive a reasonable car, you can enjoy the higher pension of the old retirement system and fill up your TSP every year, enjoying the benefit of both worlds. We have routinely saved 30% of our pre-tax income for retirement during nearly our entire Navy career, invested aggressively, and reaped the benefits. And I have a retirement pension on top of that?!?! It doesn’t get any better than that.

Resignation and Retirement Requests Transitioning to Online Process

Here is an article that discusses a change in the way we’ll be requesting resignations and retirements:

Requests for Separations, Retirements Move to Online Process

“Flaw” in New Military Retirement System?

Here is an interesting read from Military Times that discusses discount rates and what some experts consider a “flaw” in the new retirement system:

The New Military Retirement System has Major Flaw, Financial Experts Warn

Old vs New Retirement System Explained

I already discussed the value of a military pension, but this article from the Military Officers Association of America does an excellent job of explaining the old and new systems, so I wanted to reblog it for anyone who’s interested to read:

Up-or-Out Promotion Reform Stalls

Assuming they haven’t been prior enlisted, the current up-or-out rules will force officers out of the Navy at the following points:

- LT – separated if you fail to select twice

- LCDR – 20 years

- CDR – 28 years

- CAPT – 30 years

If an officer has prior enlisted time, the length of time you can stay in the military if you fail to promote is a complicated calculation and your Detailer is the best person to talk to about it.

One of the promotion reforms that has been recently discussed is a change to this up-or-out system. The argument in favor of the reform says that these rules force officers out of the military who both want to serve and possess valuable skill sets. In my experience, this can be true. I’ve seen physicians in undermanned specialties who wanted to stick around but could not due to these rules.

This article from Military Times gives you the details on how efforts to reform the up-or-out rules have stalled:

The Pentagon’s Up-or-Out Promotion Reform Stalls Amid Internal Divide

How Valuable is a Military Pension?

Two recent events led to this post. First, this article about becoming a multimillionaire in the military appeared on military.com. Second, I was having a discussion with some other officers about this topic and they thought my opinion on the subject was different from what they had heard before. Because of this, we’re going to examine the value of a military pension.

How Much of a Pension Do You Get?

Let’s look at two likely scenarios for a physician. First, someone who stays in for 20 years and retires as an O-5. Second, someone who stays in for 30 years and retires as an O-6. Their pensions in today’s dollars based on this calculator would equal approximately:

20 year O-5 = $4,102.50/month or $49,230/year

30 year O-6 = $8,053.50/month or $96,642/year

Remember that your military pension payments are adjusted annually for inflation, a very valuable benefit.

How Much is This Worth?

The easiest way to answer this is to examine the pension and figure out how much money you’d need to have invested in order to pay yourself exactly the same amount of money inflation adjusted for the rest of your life. Unfortunately, this is not a simple issue.

Military.com Article “Can Military Service Make You a Millionaire?”

The aforementioned military.com article states, “The Defense Department puts the value of the monthly check of an O-6 retiring today with 30 years of service at $2.2 million…The DoD made a number of assumptions, but the idea was to put a price tag or value on the monthly military retirement check a military retiree will receive.” This article doesn’t go into the assumptions made, but let’s just take it at face value.

My MBA Finance Professor

In 2013 when I was taking my MBA, I asked my Finance professor this very question. I asked him how he would value a 21 year O-6 pension, another common circumstance for a physician. At the time this pension was approximately $53,400/year. Here is what he said:

“If you looked at this as an ‘endowment’ where one would not spend the principal, then take the annualized benefit $53,400 ($4,455 x 12) and divide by a long-term rate such as the 30 year T-Bond rate (3% in 2013) $1,782,000. In other words, if you had that $1,782,000 and put it all into 30 year T-Bonds at 3% you would get your $4,455/month. Of course, the issue is whether the 3% is a good number for the long-term. If, however, you were to look at this as an ‘annuity’ where you would spend down the principal until time of death, then you have all sorts of demographic stats issues (e.g., expected life after retirement, future interest rates, variability of the annuity investment, cost of living adjustments, etc.). In a nutshell, it can get quite complex. There are a number of websites available often through reputable firms such as Fidelity, Vanguard, etc., that you can perhaps access that have such calculations available already (instead of having to create your own model). You can plug in your what if’s and see what pops out.”

Using the 30 year T-bond (Treasury bond) rate from 3/18/16, which was 2.68%, here is the valuation with his methodology:

20 year O-5 = $49,230/2.68% = $1,836,940

30 year O-6 = $96,642/2.68% = $3,606,044

The problem with this analysis is that a regular 30 year T-bond is not inflation adjusted, so in my opinion you’d have to compare it to TIPS (Treasury Inflation Protected Securities). A recent yield on a 30 year TIPS bond is 1.12%, which would value the two pensions we’re considering at:

20 year O-5 = $49,230/1.12% = $4,395,536

30 year O-6 = $96,642/1.12% = $8,628,750

Keep in mind that the lower the Treasury bond yields go, the more valuable your pension is because you’d have to invest more money to get the same payout. Since today’s Treasury yields are at historic lows, these valuations are probably as high as they’ll ever get.

Annuity Websites

If you go to annuity websites and try to purchase an annuity for these two amounts, here is how much they would cost:

Fidelity Guaranteed Income Estimator:

For a 20 year male O-5 who is 50 years old, lives in Virginia, and wants to earn $4,103/month or $49,236/year with a 2% annual income increase (equivalent to the inflation adjustment of your military pension) the pension would cost $1,322,826.

For a 30 year male O-6 who is 60 years old, lives in Virginia, and wants to earn $8,054/month or $96,648/year with a 2% annual income increase (equivalent to the inflation adjustment of your military pension) the pension would cost $2,103,257.

The 4% Rule

The 4% rule is a commonly accepted retirement “rule” that says you can take 4% out of your retirement nest egg every year, annually adjusted for inflation, and never run out of money. In other words, for every $40,000/year of income you need in retirement, you need to have $1 million saved for retirement. Whether the 4% rule is valid in today’s low yield environment has been debated, but let’s just assume it is still valid (because I think it is).

If you divide the annual military pension by 4% it would give you the size of the nest egg you’d need to withdraw that amount:

20 year O-5 = $49,230/4% = $1,230,750

30 year O-6 = $96,642/4% = $2,416,050

Keep in mind that your government pension is guaranteed by the federal government but the assets used in the typical application of the 4% rule, like your retirement accounts and other assets, are not, making your pension a much safer bet that is probably worth more than the numbers above.

Unquantified Value

There is some value in the military pension that people tend to underestimate. First, it is guaranteed by the US government, which makes it “risk free”. The only option discussed above that would offer this same value is the valuation comparing the pension to Treasuries. Even an annuity from an insurance company is not risk free because insurance companies do go out of business. (I will admit, though, that this is a rare event, and you could diversity by purchasing annuities from multiple companies, so an annuity can be pretty close to “risk free”.)

Second, you can’t screw it up. Investors are their own worst enemy. They buy high, sell low, trade too frequently, don’t save enough, over estimate how high their returns will be, pay excessive investment fees, and other errors that can very easily screw up your well planned retirement. You can not screw up your military pension.

Third, some states don’t tax a military pension. You can find that info here on-line or here in PDF form.

Fourth, and this benefit is HUGE for me. I see my military pension as equivalent to a massive pile of TIPS. This allows me to take much more risk with the remainder of my investment portfolio and net worth. How much risk? Overall my asset allocation is 90% in stocks, which is a lot more risk than most people would recommend at my age of 40. Because of my pension, though, I don’t think I’m taking too much risk.

The Bottom Line

As you can see, a military pension is risk free, inflation adjusted, and can be quite valuable. Can you make more money as a civilian, save well, and accumulate even more than this? Yes, but this is all determined by your civilian salary, discipline as an investor, and rate of return on your investments, which no one knows since they can’t predict the future. A military pension is a very valuable and underappreciate financial asset that is probably worth somewhere between $1,200,000 and $2,500,000, depending on how long you stay in and what rank you achieve. If you try to match the risk with Treasury bonds at today’s rates, it is worth a lot more.

- ← Previous

- 1

- …

- 6

- 7