personal finance

Opt-In to Blended Retirement System NAVADMIN

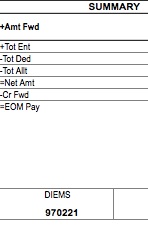

Below is the Blended Retirement System (BRS) NAVADMIN that just came out. If you are one of the people who can choose between the current system and the BRS, you can read what I think about it here. Active duty are opt-in eligible if their Date of Initial Entry into Military Service (DIEMS) is on or before 31 December 2017 and they have less than 12 years of service as of 31 December 2017. You can find your DIEMS on your LES on the right-hand side. Here is an image of my LES where you can see my DIEMS is February 21, 1997:

Because I have more than 12 years of service, I am not opt-in eligible and have to stay with the current system (thankfully).

Bottom line…stay with the current system if you are staying in for 20 years.

UNCLASSIFIED

ROUTINE

R 281546Z NOV 16

FM CNO WASHINGTON DC

TO NAVADMIN

INFO CNO WASHINGTON DC

BT

UNCLAS

PASS TO OFFICE CODES:

FM CNO WASHINGTON DC//N1//

INFO CNO WASHINGTON DC//N1//

NAVADMIN 259/16

MSGID/GENADMIN/CNO WASHINGTON DC/N1/NOV//

SUBJ/NOTIFICATION OF ELIGIBILITY TO OPT-IN TO THE BLENDED RETIREMENT SYSTEM//

REF/A/DOC/NDAA/13APR15//

REF/B/MSG/CNO WASHINGTON DC/271444ZSEP16//

REF/C/MSG/COMNAVPERSCOM MILLINGTON TN/151015ZAUG16//

NARR/REF A IS SECTIONS 631 THROUGH 635 OF NATIONAL DEFENSE AUTHORIZATION ACT,

SUBTITLE D – DISABILITY PAY, RETIRED PAY, AND SURVIVOR BENEFITS.

REF B IS NAVADMIN 217/16, ANNOUNCEMENT OF THE BLENDED RETIREMENT SYSTEM FOR

THE UNIFORMED SERVICES.

REF C IS A GENADMIN, PAY AND PERSONNEL INFORMATION BULLETIN 16-12.//

RMKS/1. This NAVADMIN is the official notification of eligibility to opt-in

to the Blended Retirement System (BRS) in accordance with references (a) and

(b).

2. Reference (a) states all Service members with a Date of Initial Entry

into Military Service (DIEMS) on or before 31 December 2017 are automatically

grandfathered under the current retirement system. However, some Service

members are eligible to opt-in to the BRS.

(a) Active component members are opt-in eligible if their DIEMS is on or

before 31 December 2017 and they have less than 12 years of service as of 31

December 2017, based on their Pay Entry Base Date.

(b) Reserve component members, to include Full-Time Support members, are

opt-in eligible if their DIEMS is on or before 31 December 2017 and they have

accumulated fewer than 4,320 retirement points as of 31 December 2017.

(c) United States Naval Academy, Reserve Officer Training Corps

Midshipmen and Delayed Entry Program members are opt-in eligible if their

DIEMS is on or before 31 December 2017.

3. The window for opt-in eligible members to enroll in BRS will be open from

1 January 2018 until 31 December 2018. Opt-in eligible Service Members must

be in a paid status at the time of enrollment. Service Members who meet the

criteria above but are not in a paid status during the election window, will

be given an opportunity to enroll during their first period of paid status.

Hardship extensions to the enrollment window for opt-in eligible Service

Members who are unable to enroll in BRS during the 2018 enrollment period

will be considered on a case by case basis in line with reference (a). If a

Service Member chooses to opt-in, their decision is irrevocable. Whether you

choose to opt-in or not, all Service Members who are opt-in eligible must

complete the Blended Retirement System Opt-In Course.

4. Commands must notify all opt-in eligible Service Members within their

command. Command administrative departments should also contact their

personnel support divisions on a regular basis to access a list of all opt-in

eligible Service Members within their command. Additionally, those opt-in

eligible Service members who have an up-to-date email address in Navy

Standard Integrated Personnel System in line with reference (c) will receive

notification of opt-in eligibility via e-mail.

5. All Navy commands must ensure that opt-in eligible Service Members

complete the Blended Retirement System Opt-In Course. This course will be

available in January 2017 on Joint Knowledge Online and Navy E-learning.

Although this course will be accessible by all Service Members, completion no

later than 31 December 2017 is mandatory for all opt-in eligible Service

Members. Additionally, command financial specialist can provide support for

unit-level basic financial literacy and BRS education. More robust financial

counseling services are available through personal financial managers at your

local Fleet and Family Support Center or online via a Military OneSource

personal financial counselor.

6. The importance of the decision to enroll in BRS or remain in the current

retirement system cannot be overstated. This decision is among the most

important financial decisions an opt-in eligible Service Member may make. I

am depending on an all-out leadership effort to ensure that the training is

completed and Service Members are making the most informed financial decision

possible.

7. This NAVADMIN remains in effect until superseded or cancelled, whichever

comes first.

8. Released by Vice Admiral R. P. Burke, N1.//

BT

#0001

NNNN

UNCLASSIFIED//

The New Blended Retirement System

There has been a lot of recent activity surrounding the new Blended Retirement System (BRS), and I don’t intend to reinvent the wheel and explain the whole system to you when there are some nice resources that already exist:

Military OneSource BRS Frequently Asked Questions

What I intend to do is give you a bottom line recommendation if you have a choice about using the current retirement system or going with the BRS.

If you know you are going to resign before you are eligible for retirement, you should select the BRS. Under the current system, you would get no retirement benefit, so that is a no-brainer.

If you are not sure how long you are going to stay in the Navy, you’ll have a tough decision to make. I’d read the above resources but also check out this article that discusses how flawed the BRS is:

New Military Retirement System Has Major Flaw

If you know you are going to stick around long enough to be eligible for retirement, my personal opinion is that you should choose to stay with the current retirement system. There are a few reasons for this:

- The BRS shifts risk from the government to you. We buy insurance when there is a risk that we can’t bear ourselves. People buy health insurance because a huge hospital bill could financially ruin them. We buy life and disability insurance because if a breadwinner died or was disabled in our household we wouldn’t have enough money to continue our desired lifestyle. The current government pension system is like retirement insurance. When it comes to retirement, the largest financial risk you run is that you outlive your financial assets. Social security insures against that, but so does your military pension, which regular readers know I highly value. Although the BRS has a pension as well, it is reduced, shifting more of this risk to you.

- Shifting risk to yourself is fine if you invest diligently and aggressively and the market earns a decent return. The problem is that most people don’t invest diligently or aggressively and no one knows what the market return will be over the next 10, 20, or 30 years. There are many people who lack the financial education they need (go here or here to get it) and invest in the Thrift Savings Plan but keep their money in the default option when you sign up, the G Fund. There is nothing wrong with the G Fund and I have some of my own retirement assets invested in it, but it is not designed to earn a high return. It is designed to not lose money and beat inflation. In order to benefit from the extra TSP money that comes with the BRS, you have to earn a high return and will need to be smart enough to invest in something more aggressive than the G Fund.

- If you control your spending, live in a reasonable house, and drive a reasonable car, you can enjoy the higher pension of the old retirement system and fill up your TSP every year, enjoying the benefit of both worlds. We have routinely saved 30% of our pre-tax income for retirement during nearly our entire Navy career, invested aggressively, and reaped the benefits. And I have a retirement pension on top of that?!?! It doesn’t get any better than that.

The $121,500+ Guest Room

I have a wife, two children, two dogs and the need for three bedrooms and two bathrooms. In March 2015 I purchased what I consider to be a modest 4 bedroom, 3.5 bath, 3000 square foot house in a nice neighborhood with quality public schools. The 4th bedroom is largely unnecessary, but like many people we occasionally have visitors and feel that it is nice to offer them a bedroom as opposed to a hotel. This is the story of how that 4th bedroom cost me over $100,000, far more than it would cost to provide our visitors with a hotel room…a REALLY NICE hotel room.

The Guest Room

The guest room and its accompanying full bathroom are approximately 600 square feet. The house sold for $140/square foot, meaning that this extra room and bathroom cost me $84,000. Where I live, you can get a decent hotel room for $100/night. In other words, I could have purchased 840 nights in a hotel room for any guests we have and I don’t think we’ll ever have 840 guest-nights unless we stay in this house for a very, very, long time. In addition, we have a quite comfortable queen size Lazy Boy sleeper couch that could have substituted for the guest room.

Running total: $84,000

The HVAC Incident

“The way they installed this, I don’t even think I can fix it.” That is not what I wanted my HVAC repair man to say, but that is what he said. The guest room did not have its own HVAC zone and because it is above the garage and the insulation is not what it could be, the guest room is always too hot or too cold. And what’s the point of a nice guestroom if it’s not comfortable? After spending $5,000, the guest room had its own wall mounted HVAC unit and zone.

Running total: $89,000

The Exchange Student

Since we have an $89,000 extra room with a bathroom and its own HVAC, we are hosting a Spanish exchange student during the upcoming school year. Hosting an exchange student will likely be a great experience for us all, as I assume it will expand our horizons and hopefully forge a lasting relationship with someone for us to visit in Spain.

I suspect this student, like most humans, will eat and drink and cost some money, so I’m adding that to the running total.

Running total: $89,000 plus whatever a 16-year-old boy eats and drinks during a school year.

Despite the fact that he is of driving age, he is not allowed to drive in the US. This, of course, led to…

The Manny Van

Sometime in August, I will have a wife, two kids, two dogs, and an exchange student. It is (was) going to be tough to get around and do the traveling we’d like to do in our Toyota Prius and Ford Fusion Hybrid. Having a 12, 15, and 16-year-old in the back seat, while technically feasible, was not going to be fun for anything other than the shortest of trips. Plus, we like to bring the dogs.

Enter the $32,500 2015 Toyota Sienna minivan, which I like to call the “manny van” when I’m driving it. I can now haul all living beings for whom I am responsible in the manliest of vans.

Running total: $121,500 plus whatever a 16-year-old boy eats and drinks in a school year

The Moral of the Story

One of the classic financial mistakes that almost all physicians make (including me apparently) is that they spend too much money, buying too expensive a car and too large of a house. Sometimes something as simple as wanting a guest room can lead to unintended and expensive consequences. If we didn’t have a guest room, I would probably have an extra $100,000 and I wouldn’t be driving a “manny van”.

Getting Your Annual CFE (Continuing Financial Education)

We are all required to get continuing medical education or CME. Just as important, however, is continuing financial education (CFE). I’m as busy as the next guy, but I am able to stay reasonably up to date on all aspects of personal finance that are relevant to my situation. Thanks to podcasts, blogs, RSS readers, Facebook, and good old fashioned books, it is easy to stay up to date. Here are some resources I recommend:

- Jonathan Clements Money Guide 2016 and his annual updates. Mr. Clements was a personal finance columnist for The Wall Street Journal, has written many financial books, and has a stellar reputation. He offers solid, no-nonsense advice and covers every topic I can imagine in this guide. Since he updates the book annually, reading it is a guaranteed way to keep up to date on personal finance. In addition, he has a blog at JonathanClements.com that you can follow, and a Facebook site as well.

- The White Coat Investor. This website is free and contains a wealth of information on personal finance topics. Founded by a physician, this site is specific to high-income professionals and often focuses on physicians. There are usually three posts per week, and you can follow on Facebook, e-mail, RSS reader, or by manually checking the blog. If you have questions on any aspect of personal finance, you can probably find a physician-focused answer on this site.

- Vanguard. The Vanguard blog and Investment Commentary podcast focus on the low-cost, passive, index fund investing that have made Vanguard the king of investment companies. The blog is an excellent source of contemporary investment information and current market trends. The podcasts occur monthly and are usually less than 15 minutes in length, making them easily digestible by busy physicians.

- Wealthfront Blog. Written by Burton Malkiel, acclaimed author of A Random Walk Down Wall Street, and other well respected financial writers, this blog is an excellent source of investing information. As you might imagine, the posts tend to focus on the benefits of utilizing Wealthfront’s robo-advisor service, but even if you don’t invest with Wealthfront the information discussed is universally applicable, especially if you invest passively with index funds.

- Mr. Money Mustache. There is an entire early retirement culture online, of which many physicians are unaware. If you have an interest in early retirement, you’ll love this website and the story of Pete (Mr. Money Mustache), a software engineer who retired in his thirties. It is filled with investing information, as well as practical advice on how to save money in everyday life. The site has an anti-consumerism, pro-Earth bent and Mr. Money Mustache is a strong proponent of using a bicycle instead of driving a car, even in the dead of winter. He will show you that retiring early and controlling your spending doesn’t have to lead to unhappiness. In fact, he’ll probably convince you that the less you own the happier you’ll be.

- Money for the Rest of Us. This podcast is hosted by a former investment manager. He does an excellent job of reviewing personal finance and economics topics in shows that are usually about 30 minutes in length. He offers additional content to those that join his “hub,” and like most money managers he thinks he can invest on the “leading edge” of the market. In other words, he thinks he can predict the future and is a little too slanted towards active management for me. That said, however, the shows are well done and extensively researched, and very entertaining with high-quality audio. Even though I don’t agree with active management, many of the topics he discusses are excellent food for thought.

If you regularly utilize these six sources of financial information, it will be easy for you to stay up to date on your CFE.

6th Step to Financial Freedom – The Rent vs Buy Real Estate Decision

The classic advice has always been to purchase your home if you can afford it, but in the military the decision is much more complex. You can’t simply compare your rent versus a mortgage payment. You have to consider tax breaks, fees associated with purchasing real estate, and how long you expect to stay at your duty station. Here’s a breakdown as I see it:

Benefits of Home Ownership

- Interest payments and property taxes are deductible.

- When you sell, gains on home value are federal tax exempt up to $250K if single and $500K if married.

- Making regular mortgage payments forces you to save.

- You can get some significant asset protection as many states protect home equity from lawsuits.

- As you make mortgage payments and accumulate home equity, it serves as a diversifier in your investment portfolio. Real estate is a great hedge against inflation and is only moderately correlated with traditional investments like stocks and bonds.

- Mortgage rates are rock bottom right now, making it easier to purchase a home.

Downsides of Home Ownership

- Most home purchases have a 3-5 year break even period, which just happens to coincide with the length of most residencies and military tours of duty.

- Real estate appreciation barely keeps up with inflation over the long haul.

- Sudden moves can force you to either sell your house or become a landlord.

- The classic teaching is that purchasing a home is a great investment because you don’t have to pay rent, but buying a home that is too expensive will harm you financially because of all the associated costs, such as heating, cooling, insurance, maintenance, buying, and selling. Expect to pay 5% of the value of the house when buying it, 1-2% of the value each year to maintain it, and 10% of the value when selling it.

Benefits of Renting

- You avoid the fees and ongoing expenses associated with buying, maintaining, and selling a home.

- Rental contracts have military clauses that will allow you to get out of a lease in the event of a sudden military directed move.

- In high-cost areas (Hawaii and San Diego are frequent duty stations that fit this description), it is often much more affordable to rent than to buy.

Downside of Renting

- You don’t get the benefits of home ownership listed above.

Rent vs Buy Calculators

You don’t have to make this decision on your own. Here are two on-line calculators to help you make your decision:

New York Times Rent vs Buy Calculator

The reality is that this is a very personal choice, and there really isn’t a right or wrong answer. What you should do will be based purely on your personal values and likely career path. My personal bias would be to make sure that by the time I retire I have paid off the mortgage on my primary (and hopefully only) residence.

“Flaw” in New Military Retirement System?

Here is an interesting read from Military Times that discusses discount rates and what some experts consider a “flaw” in the new retirement system:

The New Military Retirement System has Major Flaw, Financial Experts Warn

Guest Post: Supplemental Disability Insurance for Active Duty Physicians

(EDITOR’S NOTE: While we have great benefits in the military, one area where our benefits fall short is disability insurance. If we were to be disabled on active duty, our disability pay would not reflect our physician bonuses and higher income. For years I struggled to find supplemental disability insurance. I used the American Medical Association plan because they’d give me up to $2500/month of additional coverage and it was all I could find. That was until I contacted Andy Borgia at DI4MDs.com. He was able to get me the amount of coverage I needed when many, many other people couldn’t. For some reason many disability insurers don’t want to cover active duty. Below is a post from Andy about supplemental disability insurance.)

May is disability insurance awareness month and also the time of the year a number of physicians transition into new positions due to the completion of most training programs July 1st. As a result, it is an excellent time to examine protecting the most valuable asset any physician has, their ability to practice and earn an income. Whether you are a military physician with a number of years left to serve, soon to be exiting the military or currently in a residency/fellowship program, it would be prudent make certain you are adequately protected in the event you become disabled and unable to practice due to a sickness or accident. Statistics, which can be found all over the internet, including our site, indicate approximately 1 in 3 people will be disabled during their working career, which can be the cause of financial ruin. Disability insurance for physicians is universally recommended.

Being active duty military, you may think you are already adequately protected. This is far from accurate since military disability benefits only cover base pay and do not include incentive, special or bonus pay, allowances or private earned income. These extra forms of income usually provide the majority of a military physician’s pay and should and can be protected. If you are about to leave the military, the day after you are discharged, any military disability coverage will cease and you will be completely unprotected. Establishing an individual disability insurance policy can take up to 4 months, since medical records must be obtained so to be adequately protected requires advanced planning.

To make certain you and your family are protected, establish an individual disability insurance

policy. The individual policy contractual provisions should protect you in your chosen medical specialty for the entire benefit period, provide both total and partial disability benefits, allow for an increase in coverage upon completion of duty without additional medical requirements, and be noncancelable and guaranteed renewable (policy cannot be cancelled, premiums changed, coverage altered by the insurance company). Residents and fellows may be eligible for discounted polices if established prior to completion of training and should be taken advantage of.

Contact an experienced insurance agent that represents a number of companies and is familiar with contractual provisions and underwriting procedures, it does make a difference, to explore your

options. Please visit our website www.DI4MDS.com to obtain our Military Physician Disability Insurance Guide. This will provide an educational first step.

For a complementary personal disability insurance consultation please contact me directly (Andy G Borgia CLU, andyb@di4mds.com, 888-934-4637).

- ← Previous

- 1

- …

- 59

- 60