My Investment Portfolio

I write a lot about personal finance. If you are wondering what I’m doing for my own finances, here’s a detailed look at my own portfolio. I’m not going to give you dollar amounts, but percentages. If you want to know the dollar amounts, they can be expressed in one word. I have…enough:

At a party given by a billionaire on Shelter Island, Kurt Vonnegut informs his pal, Joseph Heller, that their host, a hedge fund manager, had made more money in a single day than Heller had earned from his wildly popular novel Catch-22 over its whole history. Heller responds,“Yes, but I have something he will never have . . . enough.”

Assets

My financial assets from largest to smallest include: (all percentages are rounded to the nearest whole percentage)

- 24% – My taxable mutual funds, which is where I put our retirement savings when I fill our retirement accounts. It is currently invested in:

- 56% – Vanguard Total Stock Market Index Fund Admiral Shares (VTSAX)

- 37% – Vanguard Total International Stock Index Fund Admiral Shares (VTIAX)

- 7% – Vanguard Prime Money Market Fund Investor Shares (VMMXX)

- 21% – My Thrift Savings Plan (TSP) – Currently invested in this proportion:

- 91% – US stocks

- 75% – C Fund

- 25% – S Fund

- 1% – International stocks (I Fund)

- 9% – US bonds split evenly between the G Fund and F Fund

- 91% – US stocks

- 15% – My paid off house.

- 12% – My wife’s TSP, which is invested 100% in US bonds with a 50/50 split of the G and F Funds.

- 12% – My wife’s Roth IRA, which is invested in:

- 53% – Vanguard Total International Stock Index Fund Admiral Shares (VTIAX)

- 47% – Vanguard Total International Bond Index Fund Admiral Shares (VTABX)

- 9% – We have two 529 plans with Vanguard invested in their aggressive age-based portfolio.

- 6% – My Roth IRA, which is 100% invested in the Vanguard Total International Stock Index Fund Admiral Shares (VTIAX).

- 1% – My wife’s individual 401k, which is 100% invested in the Vanguard Total International Stock Index Fund Admiral Shares (VTIAX).

- 1% – My wife has a 401k that is invested in the Fidelity® 500 Index Fund (FXAIX).

Liabilities

None. Aside from credit cards we pay off every month, we’re debt free.

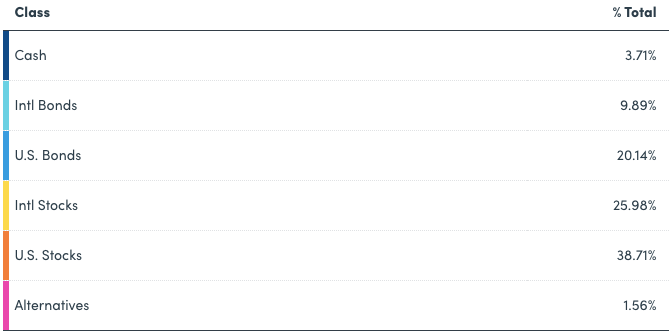

Overall Asset Allocation

Excluding the pension and my house, here’s my overall asset allocation courtesy of our favorite tool that made all of this easy, Personal Capital:

November 9, 2019 at 09:42

Don’t know if you are interested, but in this environment with many projecting lower returns for the US stock market going forward (not that anyone really knows). Managed futures (like Dunn Capital or Chesapeake) may be a vehicle for diversifying.

Best, Andy

________________________________

LikeLike

November 9, 2019 at 13:15

I keep it simple and don’t believe you need any diversification beyond stocks and bonds. Real estate would be where I’d go next if I wanted to add an asset class, but I don’t.

LikeLike

January 8, 2020 at 10:02

What is your reasoning for investing in 529’s as opposed to mutual funds in your name? Do you assume the children will absolutely need the money for school? What would be the penalty if they don’t use the money and you decide to repurpose the money for you and your wife? Thanks in advance!

LikeLike

January 8, 2020 at 17:54

529 are tax advantaged for money you KNOW will go toward educational expenses. If you are not sure, I don’t think there is anything wrong with skipping 529 plans and giving yourself some flexibility. For example, I actually stopped contributing to them 8 or so years ago once they allowed us to transfer the GI Bill to our kids. We have 2 kids and 2 GI Bills, so now I have 529 money I may need for grad school or may not need, in which case I can redesignate a new beneficiary who will use the money for educational expenses or pay a 10% penalty plus tax.

LikeLike

January 9, 2020 at 11:00

Thanks for the response, that helps a lot! I thought the penalty tax was a bit higher (in excess of 20% in some instances). Do 529 plans have different penalty taxes dictated by the state?

LikeLike

January 9, 2020 at 21:23

I don’t think so. Verify the penalty with the state you use but I think it’s a 10% federal penalty.

LikeLike

February 4, 2020 at 02:14

Very nice article! I enjoyed a lot Reding it. Thanks for sharing.

LikeLike

February 3, 2021 at 11:32

Thanks! Nice to see the distribution with Vanguard and TSP. Just shared with friends as well.

Are your percentages still the same for this past year?

Vanguard question:

Does it make sense to hold both VTSAX and VFIAX? I also have VTIAX (plus MM/bond)

TSP: Currently at CSI%: 38/43/17 – looking to rebalance closer to 50/40/10 but open to suggestions.

What’s your ideal balance with US stocks/Intl stocks/Bonds- we are shooting for 60/20/20 and dream would be to retire in 1o years with Navy pension, should we be more aggresive, closer to 10% bonds right now?

Thanks!

LikeLike

February 3, 2021 at 11:39

My percentages are close to target as I rebalance anytime they are 5% or greater off, and I check monthly.

Holding VTSAX gets you exposure to small stocks whereas VFIAX only holds large/moderate cap stocks.

What your target asset allocation should be is too individual for me to comment on, but your percentages seem reasonable. You are light international exposure to my taste, but anything from 0% to 50% is backed by an expert somewhere.

I do what Vanguard does, which is a 60/40 ratio of US/international stocks.

LikeLike